Share this story

- "We really need to make sure that our public schools have reliable, predictable, stable funding sources so they can continue to serve students and provide them with a sound, basic education," said Geoff Coltrane, senior education advisor to Gov. Cooper.

- State leaders briefed reporters about the possible impact of tax cuts being considered by the N.C. General Assembly on public education. The scale of the tax cuts could limit the state’s future ability to fund public education, they said.

|

|

Today at 11 a.m., Geoff Coltrane, the senior education advisor to Democratic Gov. Roy Cooper, briefed reporters about the possible impact of tax cuts being considered by the N.C. General Assembly on public education. Coltrane was joined by Kristin Walker, the director of the N.C. Office of State Budget and Management (OSBM), and Ronald Penny, the secretary of the N.C. Department of Revenue.

“The scale of these tax cuts,” Coltrane said, “would severely limit the state’s ability to fund public education moving into the future.”

Republicans have proposed what President Pro Tem Sen. Phil Berger, R-Rockingham, calls the “largest expansion of school choice” since the state started the Opportunity Scholarship program 10 years ago. The Senate budget proposal only included a $20 per month raise for educators with 14 or more years of experience and would increase funding for vouchers more than it increases funding for the teacher salary schedule.

In response to the proposed legislation coupled with proposed tax cuts, on May 22, Cooper declared a state of emergency for public schools in North Carolina.

Since then, Cooper has issued press releases on education issues, from vouchers and the expansion of school choice and increasing teacher pay to investing in early childcare and the teacher pipeline and the number of vacancies ahead of the start of the school year.

Cooper has visited communities across the state – from Raleigh and Charlotte to New Hanover, Greene, Alamance, Guilford, Ashe, and Buncombe counties – to express his concern about the impact of proposed legislation on the future of our public schools.

He has visited early childcare centers and schools and community colleges.

Cooper sent a letter to legislators. He urged Congress to invest in child care.

By June 12, 25 school districts had expressed concern about the impact of the proposed legislation.

By June 19, the number had increased to more than 30 school districts.

By July 6, the number was up to more than 35 school districts.

By July 19, the number was more than 40 school districts, including urban and rural districts in counties that lean Republican and that lean Democratic.

Some school boards passed resolutions. Nineteen superintendents in northwest North Carolina sent this letter to the legislature.

Today’s briefing of the press happened one day after Cooper called on the legislature to pass a budget.

The budget process slowed after the July 4th holiday as Speaker of the House Tim Moore, R-Cleveland, found himself in the news. Moore also recently indicated he does not plan to run for speaker again.

Moore and Berger have been hashing out budget differences between the two chambers. And next week, conservative legislators are heading to the 50th annual meeting of the American Legislative Exchange Council (ALEC), where workshops on “Building on the Momentum for Education Freedom” and “The Educational Choice Movement: Red, Blue, or Purple” are on the agenda.

On July 11, amid the Governor’s state of emergency and the legislature’s summer break, CNBC named North Carolina No. 1 for business for the second year in a row, noting our “world-class workforce and booming economy.” In 2022, when our state was first named No. 1 for business, the CNBC headline read, “By putting partisanship aside, North Carolina ranks No. 1 in America’s Top States for Business, with the nation’s strongest economy.”

In the briefing today, Coltrane said, “our state’s ability to continue to build the workforce — which has led us to have the strong economy that we have and be the No. 1 state for business two years in a row” is threatened by Republican budget proposals.

Coltrane said when you layer the scale of the proposed tax cuts with what he called the state’s “underinvestment in education,” along with the proposed expansion of school choice, “we are going be really be damaging ourselves for the future — from being able to continue to be the economically strong state that we have been and have the workforce that we know is going to be needed moving forward.”

The briefing on the impact of the proposed tax cuts

Coltrane started the briefing with this slide, and the argument that “public education is the most important activity state and local government undertakes.”

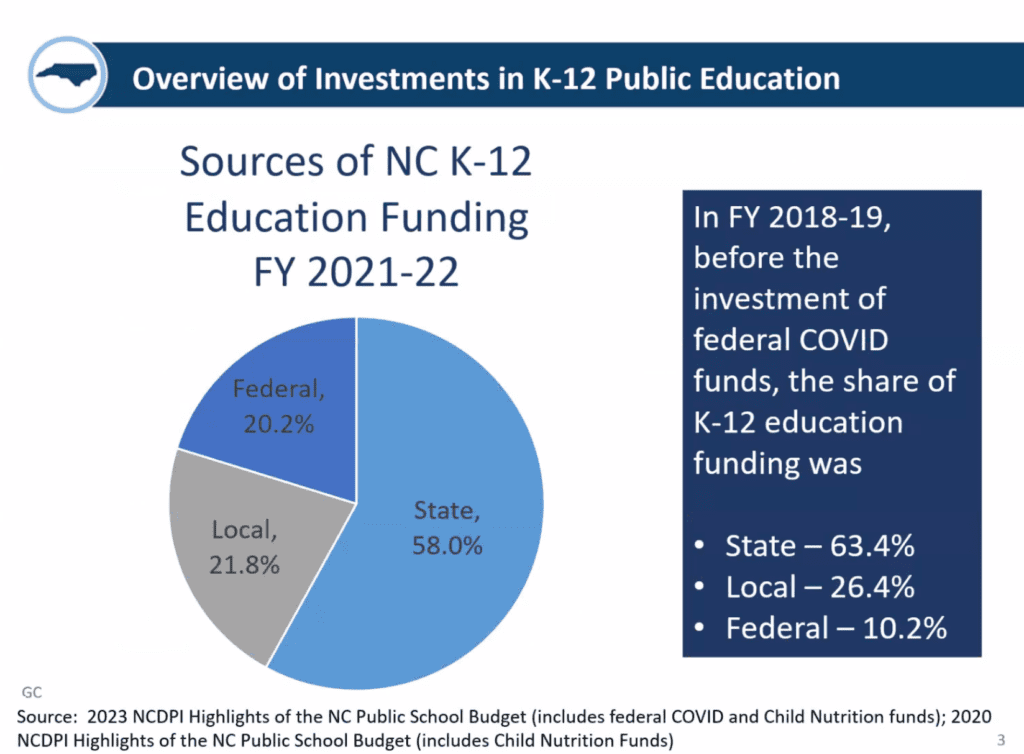

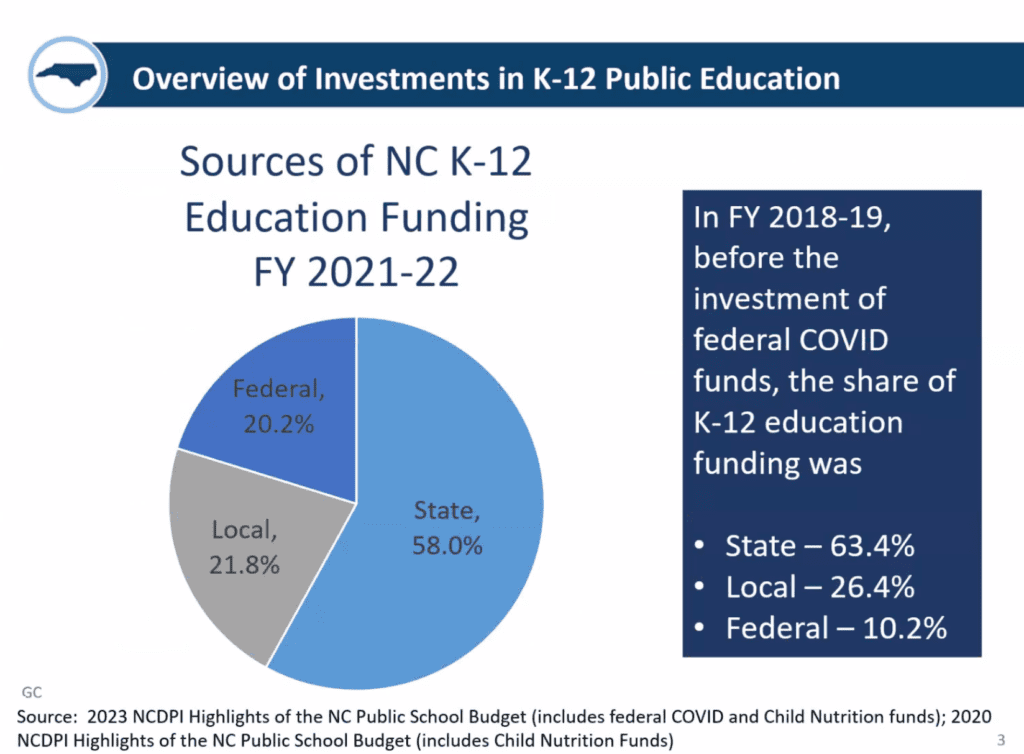

Here are the sources of K-12 funding, according to the state leaders on the call. Note that the share of state funding in 2021-22 was impacted by federal COVID relief dollars.

As EdNC has previously reported: “How we choose to spend our money as a state is an indication of our priorities. That starts with tax policy, which determines how much revenue will be available to fund our priorities.”

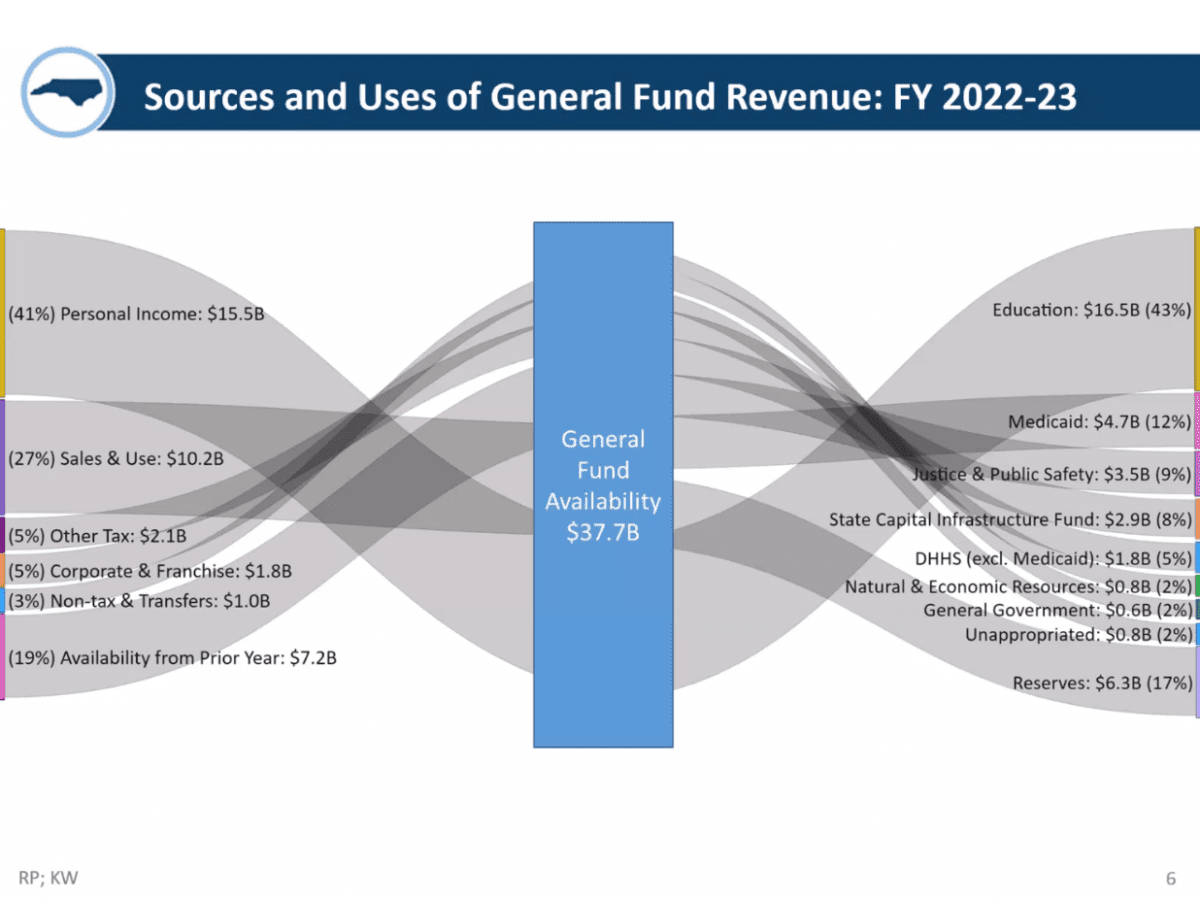

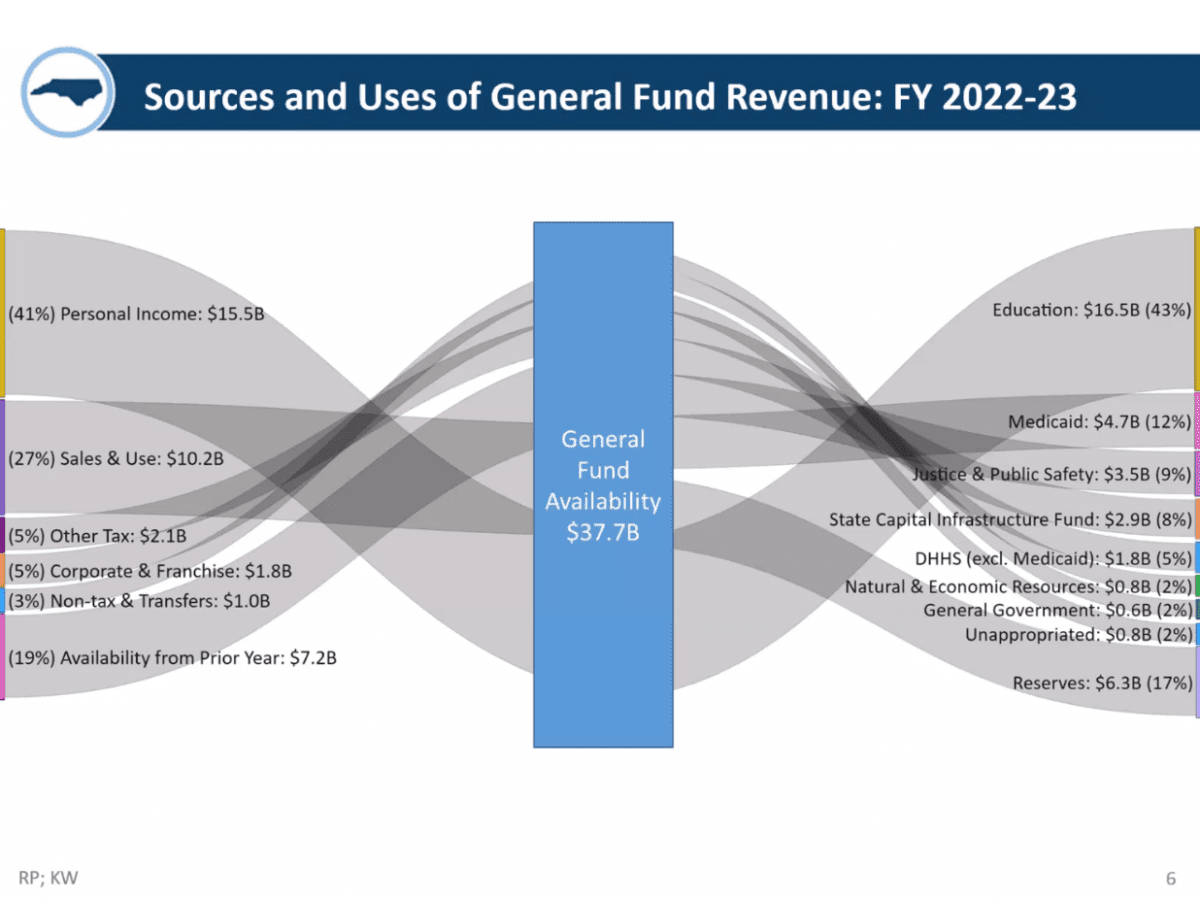

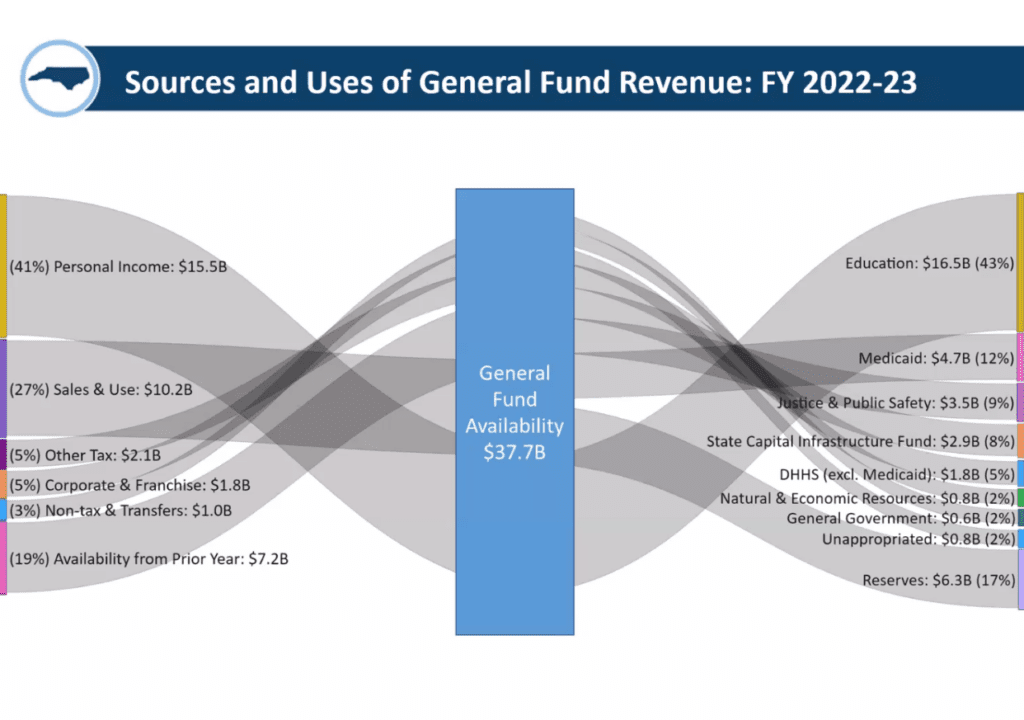

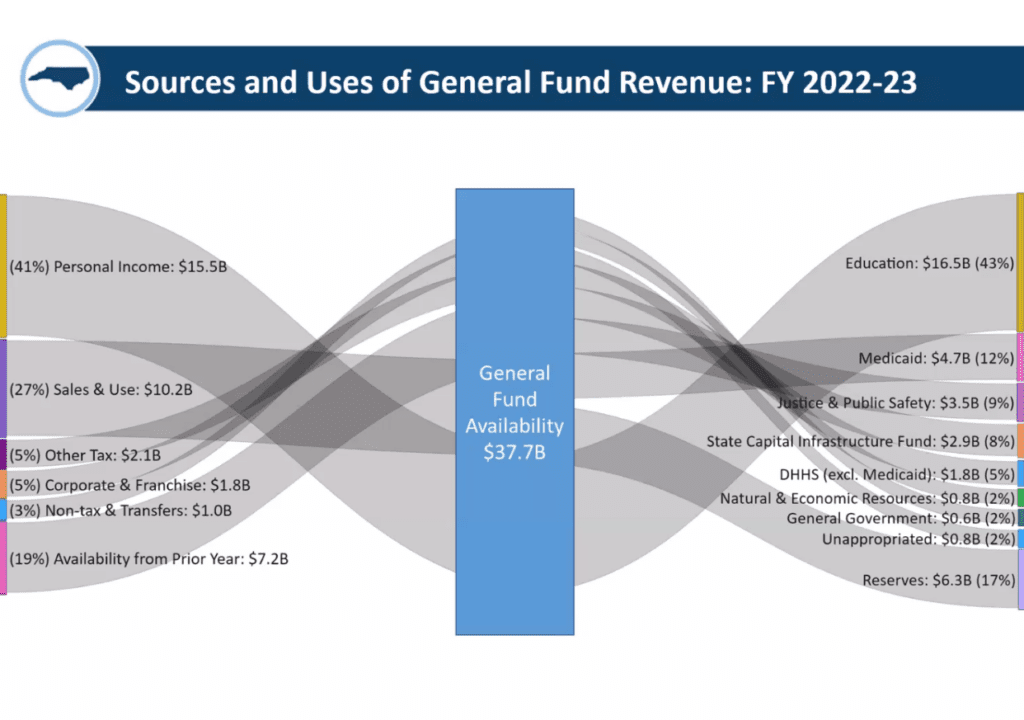

The graphic below shows where state revenue comes from on the left-hand side, and what it funds on the right-hand side, according to the state leaders on the call.

You can see 41% of general fund revenue comes from personal income taxes, and 43% of general fund revenue is spent on education.

“Even a small percentage change, when you are talking about the largest part of the pie, makes a significant dollar difference for North Carolina,” said Secretary Penny, who leads the Department of Revenue.

The proposed tax cuts would impact personal income and corporate tax. Those taxes make up 46% – nearly half – of the state’s general fund revenue, Penny said.

He also noted the 19% of general fund availability for FY 2022-23 comes from overcollections from the prior year.

“Obviously as the rates move down, those overcollections will not be occurring,” he said.

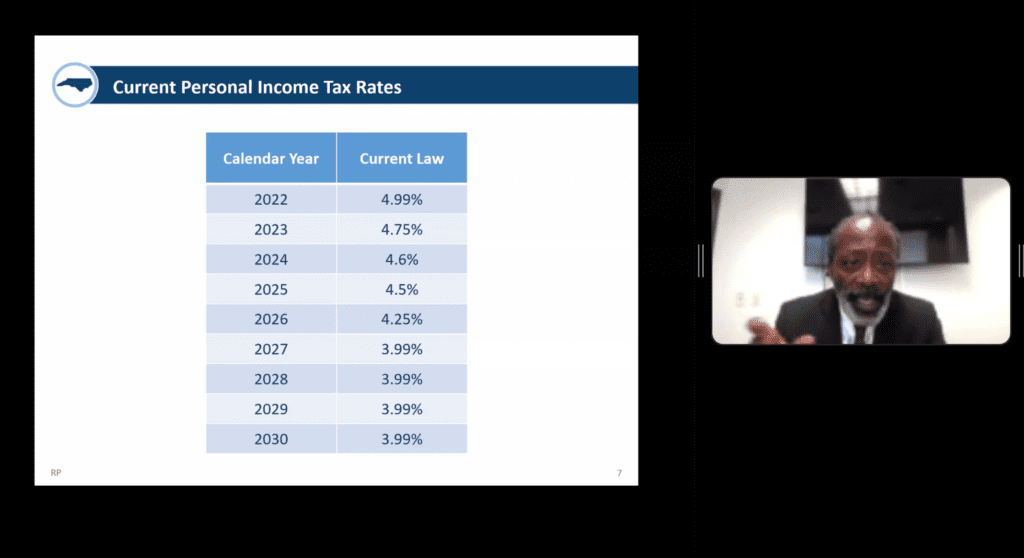

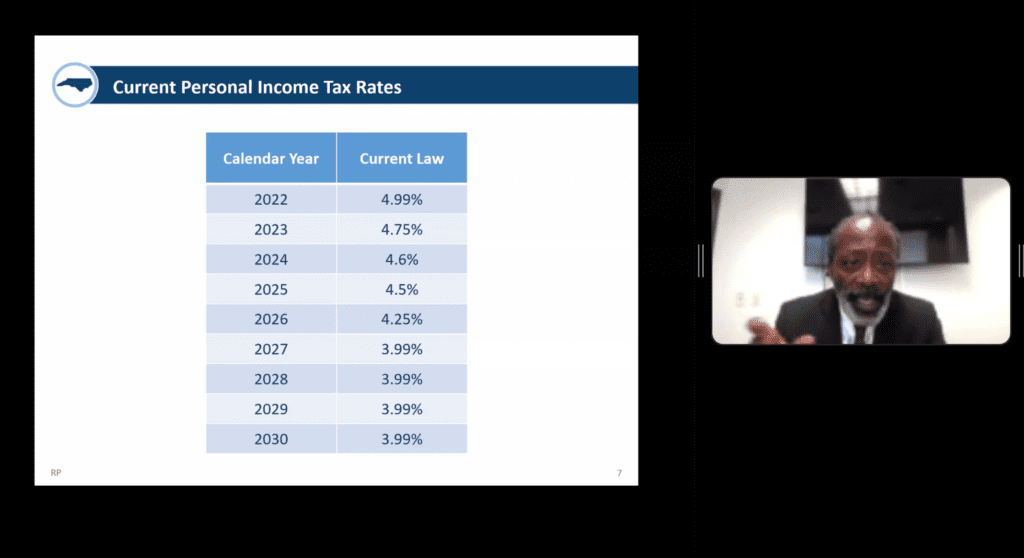

Penny then walked those on the call through the current personal income tax rates, outlined on the screenshot below.

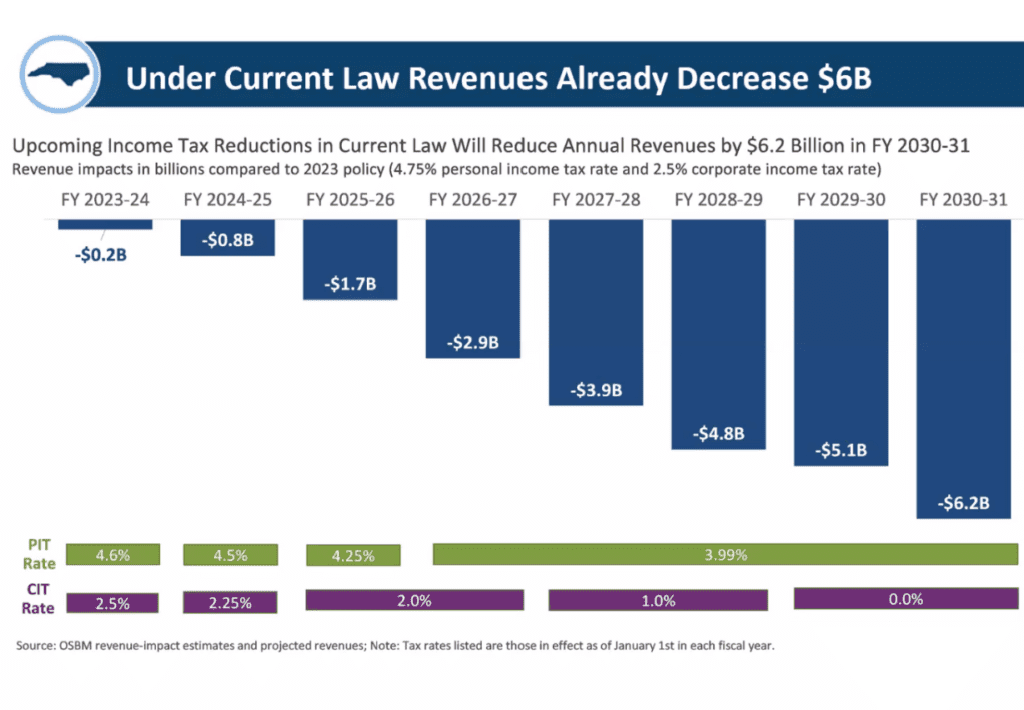

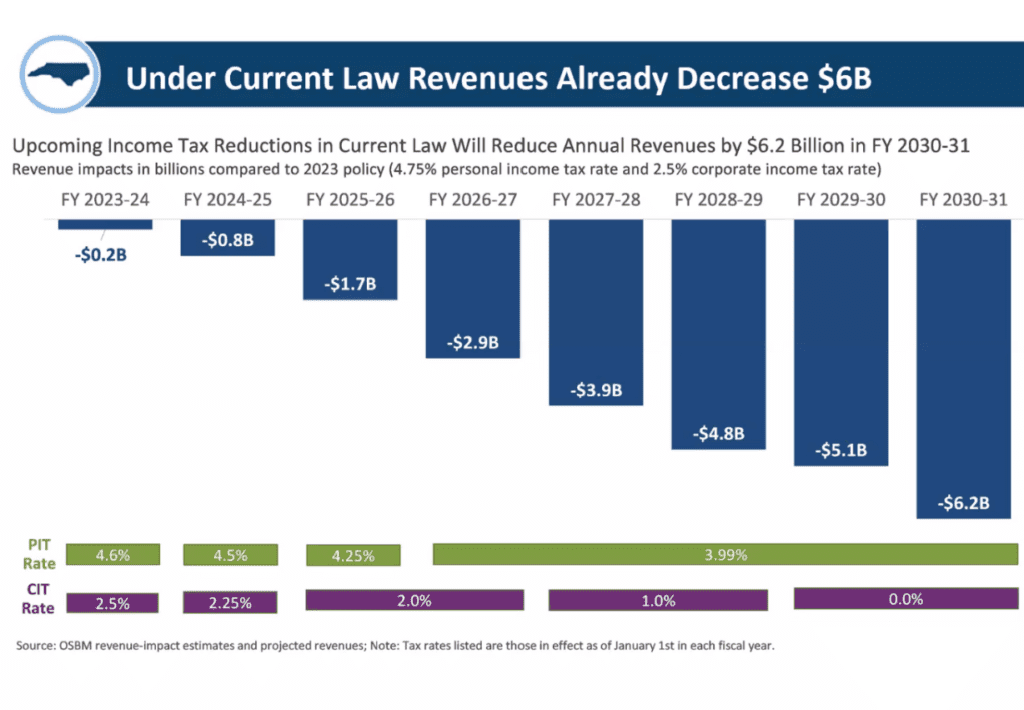

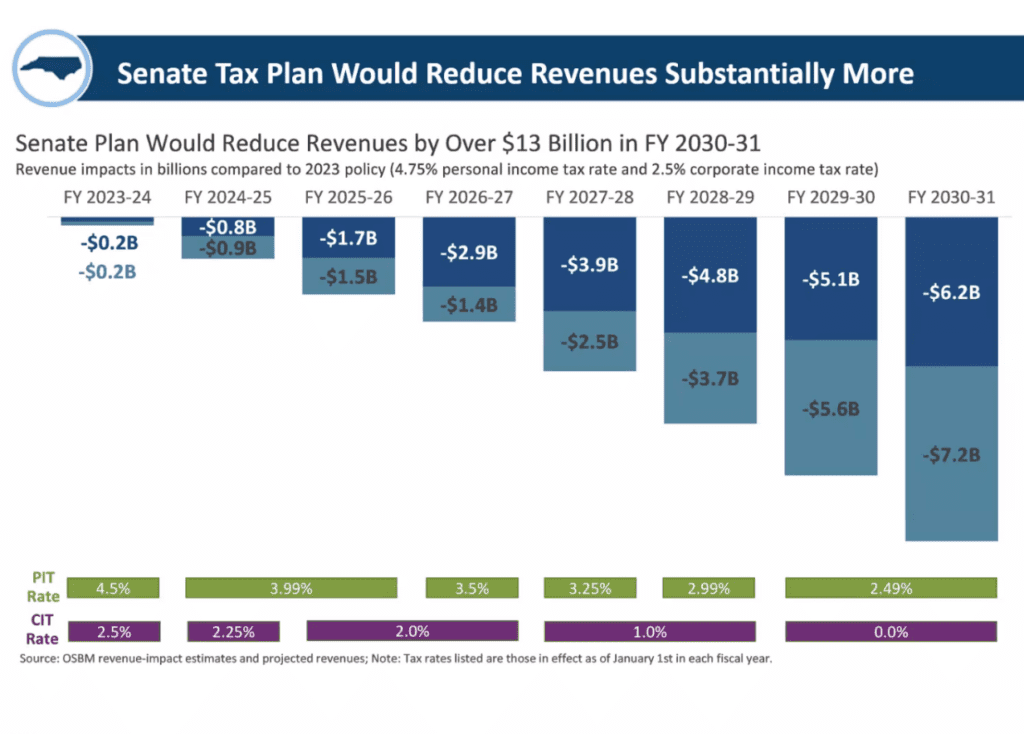

Penny said under current law, upcoming income tax reductions would reduce annual revenue by $6.2 billion in 2030-31. You can see the projections below.

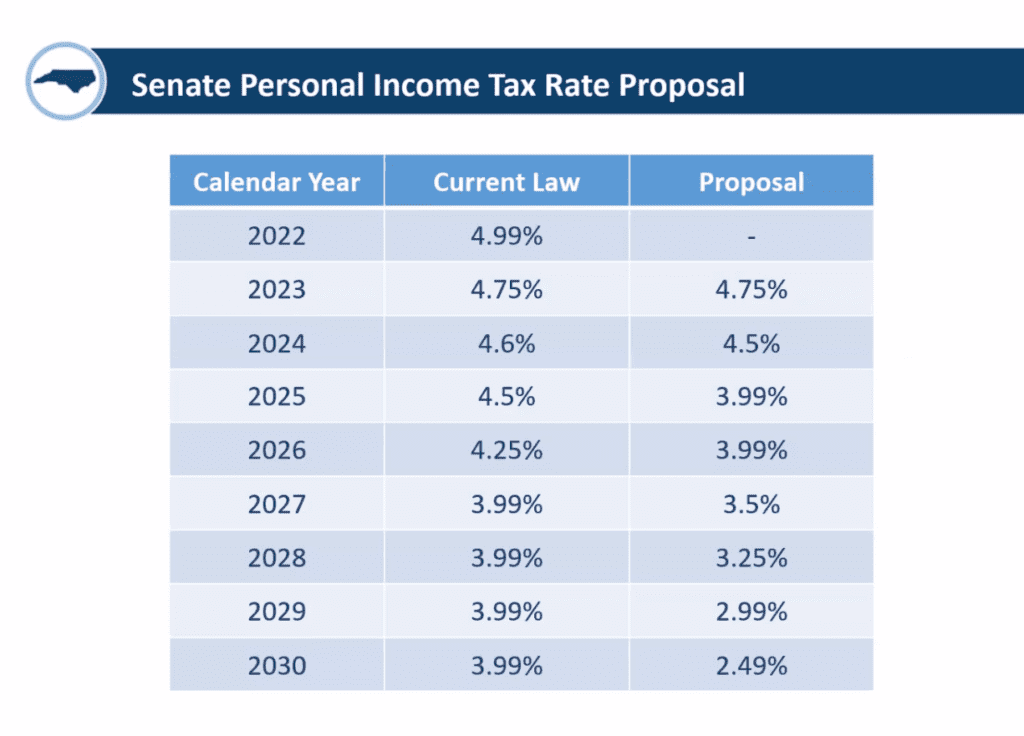

Here is the Senate’s personal income tax rate proposal, according to the Governor’s office.

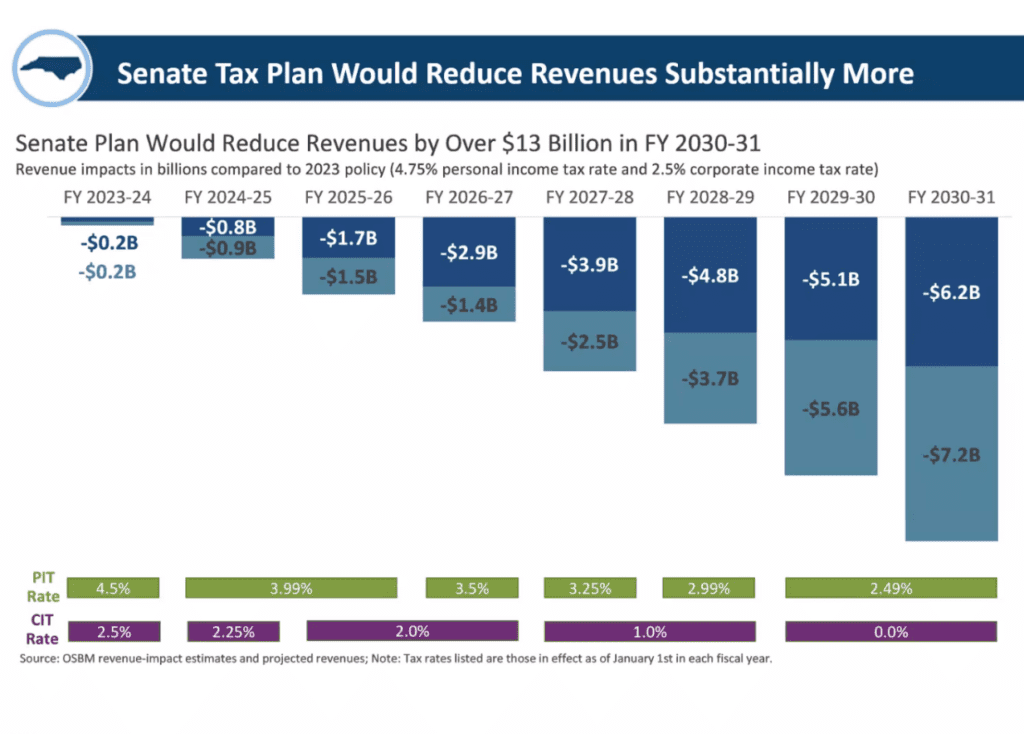

According to modeling used by the state leaders on the briefing, the Senate’s proposed tax plan would reduce revenue by another $7.2 billion, so that by 2030-31 the state could anticipate a reduction in revenues totaling more than $13 billion.

“Which is nearly 20% of the state’s general fund,” said OSBM’s Kristin Walker. “That is not very far away and is a significant hit.”

“There’s not really anything proposed to make up that revenue, nor are there proposed cuts about what you would no longer fund under such a scenario,” she added.

The state leaders said North Carolina is growing by 100,000 residents per year, meaning more people would need to be served with less money.

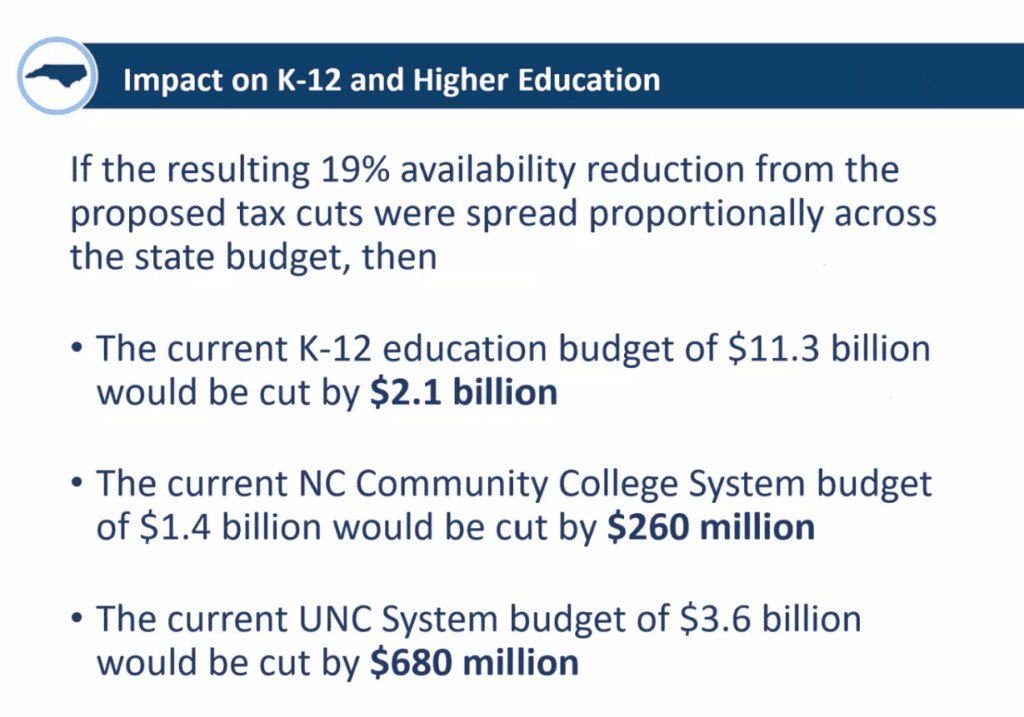

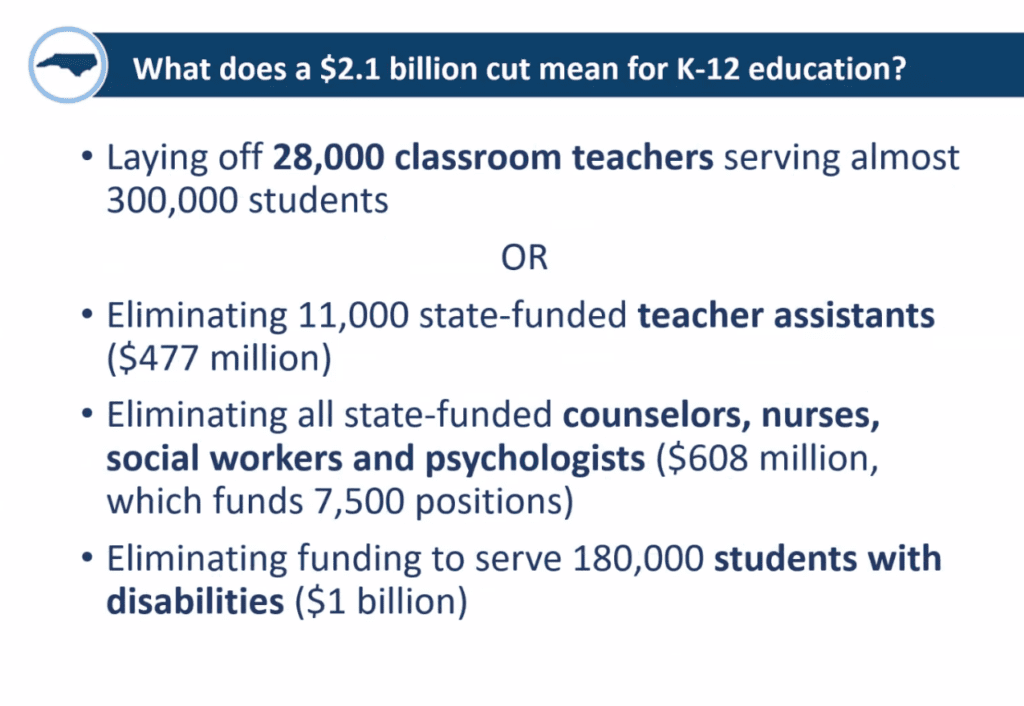

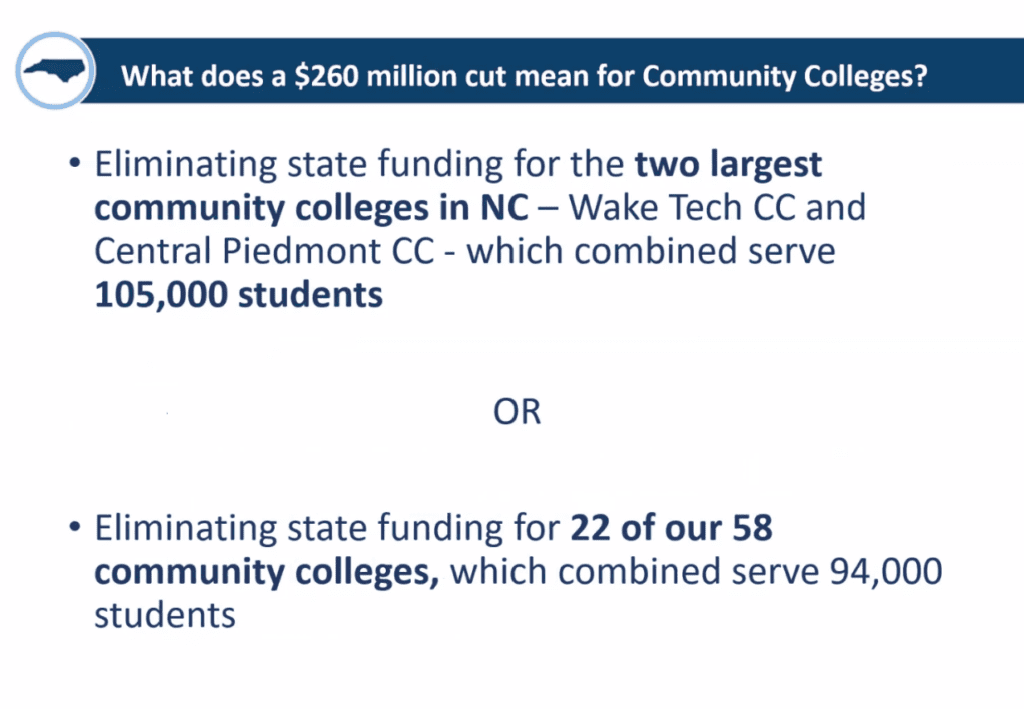

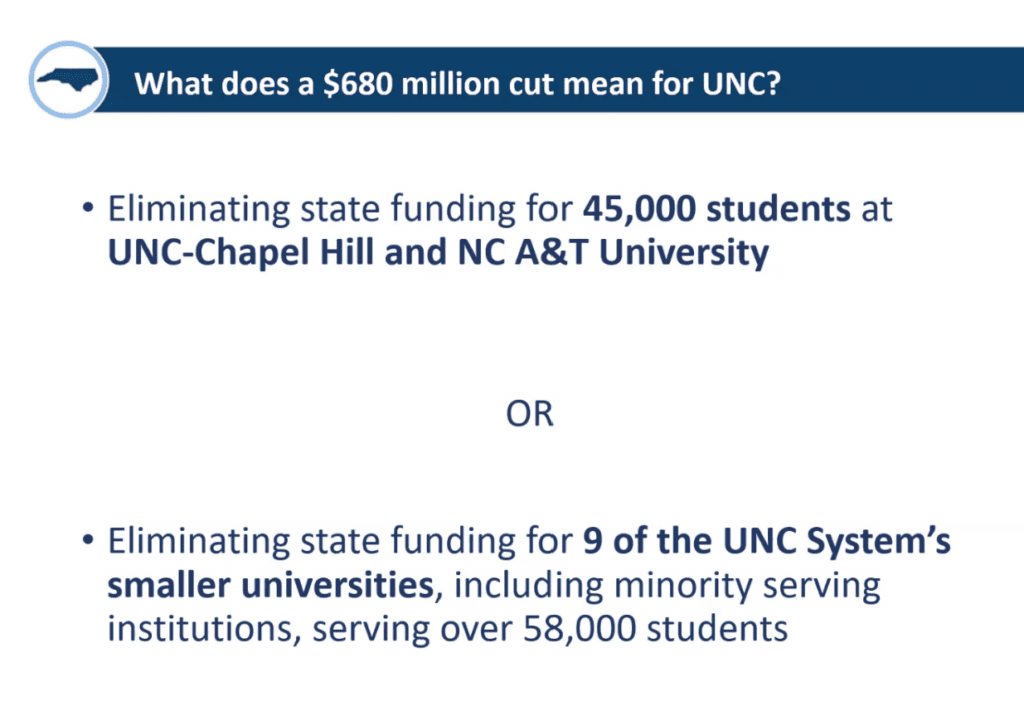

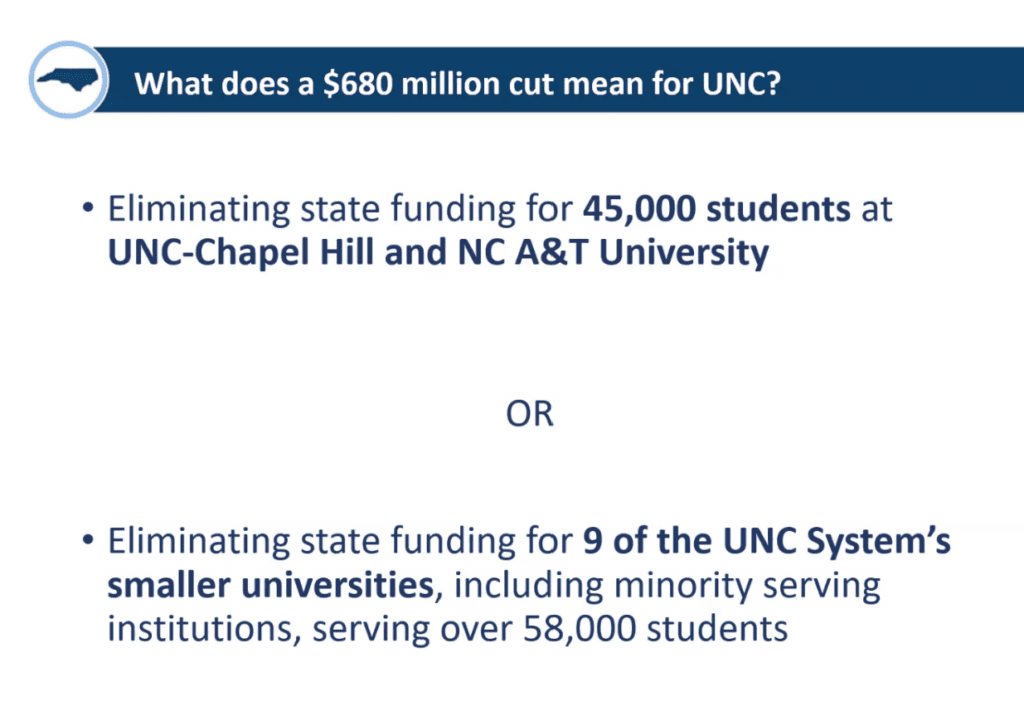

Coltrane, Walker, and Penny walked reporters through a hypothetical scenario to better understand the impact of those tax cuts and loss of state revenue on education. If the reductions in revenue were equally applied across the state budget (which they can’t be because of nondiscretionary spending, like Medicaid, for example), here are their estimates:

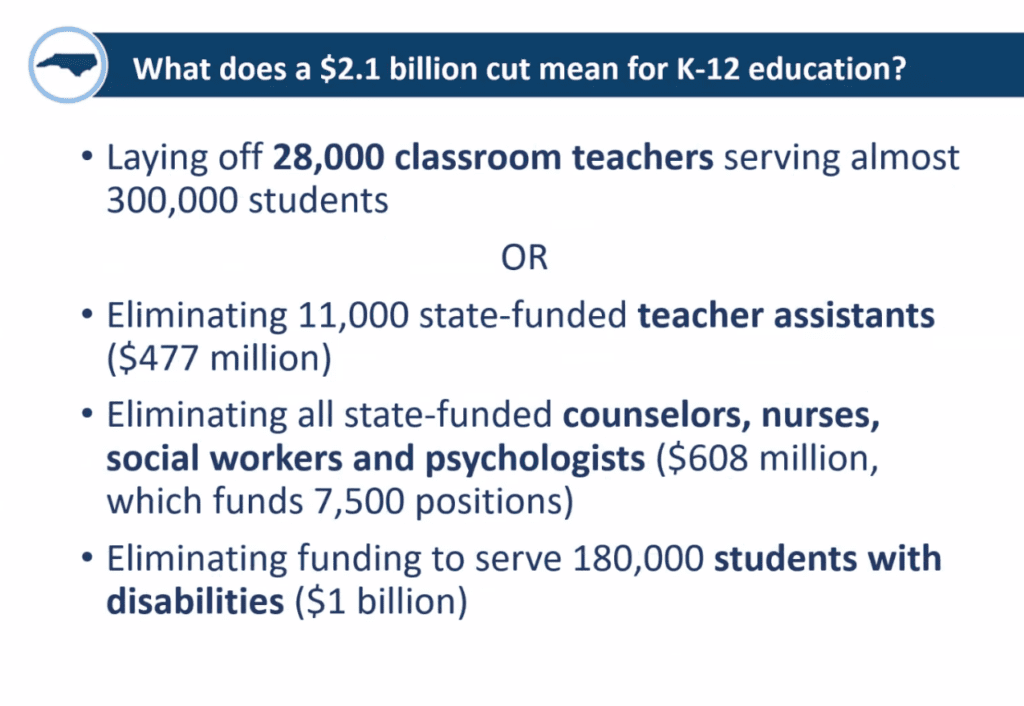

What could cuts like that mean for K-12, community colleges, and public universities?

Coltrane noted that future legislatures would make these decisions, and “this is really intended to be an example of the scale of the proposed cut.”

Other takeaways from the briefing

The state has $15.2 billion in cash on hand with close to $6 billion of that unreserved, Walker said.

“The state has a very healthy cash balance right now,” she said.

Coltrane said most of the state’s education dollars go toward people.

“Education is a very people-intensive endeavor,” he said. “We need lots of teachers, principals, counselors, support staff, bus drivers, and so more than 90% of state K-12 funds in the 2021-22 fiscal year went to help provide salaries and benefits for educators and other personnel providing education to our students.”

Walker said additional streams of revenue being considered by the legislature – like sports gambling and video lotteries – would not come close to making up the revenue loss, according to OSBM’s modeling. She noted this type of gambling could impact lottery sales, which is a dedicated revenue stream for education that is used for public school capital funding.

“I don’t think gambling is a magic bullet to make up $13 billion,” Walker said.

Walker said a revenue adequacy trigger could be helpful if these cuts move forward.

Republicans historically have noted that concerns like these are raised whenever tax cuts are proposed, and yet the state has taken in more money than projected. In assessing the possible impact of these proposals, Walker stressed the scale of the proposed tax cuts, the lack of revenue replacement or other broadening of the tax base, the strength of the economy, and the risk of a recession or “slow-cession.”

“It’s really difficult to hire teachers, counselors, nurses, teacher assistants, bus drivers when you are not sure you are going to have that money the next year,” said Coltrane. “We really need to make sure that our public schools have reliable, predictable, stable funding sources so they can continue to serve students and provide them with a sound, basic education. And that also applies to our community colleges and universities as well.”