How many North Carolinian households are considered cost-burdened? According to 2012 data by the Harvard Joint Center for Housing Studies, 1.2 million of the state’s households are spending over 30% of their income on housing. Want to see a county breakdown? Check out the North Carolina’s Housing Coalition interactive map here.

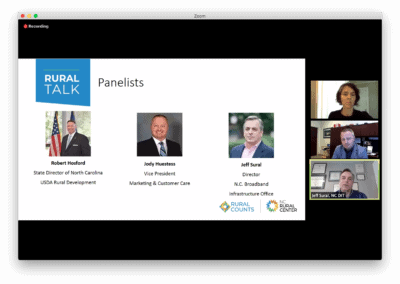

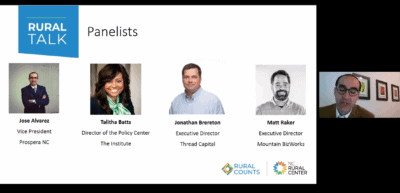

Combine the above information with the current unemployment claims due to COVID-19, and the affordable housing crisis is in the middle of a perfect storm. In the fourth installment of the Rural Talk: A Virtual Advocacy Speaker Series by Rural Counts, panelists and representatives gathered to talk about housing.

“Housing is not just the roof over our heads,” said moderator Debby Warren, who is a consultant for nonprofits. Warren continued by saying that housing drives a family’s health and educational outcomes, drives local economies, and is one of the basic requirements for living.

Panelists for this webinar on rural housing included Samuel Gunter, executive director of the North Carolina Housing Coalition, Laura Hogshead, COO of the North Carolina Office of Recovery and Resiliency (NCORR), and Sallie Surface, executive director of the Choanoke Area Development Association of North Carolina (CADA). At the end, two state legislators joined the call — Rep. David R. Lewis, R-Harnett, and Rep. Yvonne Lewis Holley, D-Wake.

The previous three Rural Talk discussions covered broadband access, small businesses, and health. The fourth discussion can be found below, and if you are interested in joining the final conversation which will focus on water and wastewater infrastructure, sign up here.

Tackling the affordable housing puzzle

What is the housing need in a community? According to Surface, there is a magnitude of diverse challenges that can all look different. The need ranges from urgent repair or rehabbing a house that currently stands, to weatherization, which helps save energy and reduce utility bills.

Energy bills and the ability to pay on time directly impacts credit, which is one of the most important issues on the pathway to homeownership. Gunter says that for more than half a century, housing and particularly home ownership has been the primary way low- to moderate-income families have built wealth. He says housing is “the first rung on that ladder of opportunity, everything begins at home.”

What other things may a community need in order to address the affordable housing crisis? To build single family homes or multifamily senior housing. What if people want to “stay in place, and age embrace” the homes they already live in? The needs are different, and the pool of money is small, Surface said.

“If housing impacts every part of everyone’s life; from the safety from the health from your economic standard, and your zip code sometimes determines your success in life, it is essential that we look at how housing impacts what we do.” – Sallie Surface, CADA

Related reading

Hogshead agrees with Surface in that “there’s no one size fits all.” It’s about capacity at the local level and it’s about listening to what that community wants. “You just have to be sensitive to the local needs and you can’t go in with, this is the one way we’re going to do it [attitude], because what we’re finding is that every strategy needs to be tweaked a little bit to best fit the nature of that place.”

NCOOR is in the process of receiving over $500 million in Community Development Block Grant-Disaster Recovery funds in response to the destruction of Hurricane Florence. She says in the two years it has taken to receive the money, her offices have had time to plan. They looked at the recovery response from Hurricane Matthew and realized, “that even though it is easier and faster to just repair what was broken, it is not going to make that family safer.”

“I think when you have two major hurricanes in 23 months, it makes you think differently about the flood maps and makes you think differently about your personal risk.” – Laura Hogshead of NCOOR

What is the NCOOR going to do to help mitigate housing risks for future storms? Elevations, reconstructions, and voluntary buyouts. Hogshead acknowledges people will want to stay in their communities, because “housing is your identity and it is the base from where you live your life.”

They are working with the North Carolina Housing Finance Agency and other developers to make sure that there are options for people that are affordable and safe and outside of the floodplain.

“These housing needs are not new needs. They existed before the pandemic and they will continue after.” -Sallie Surface of CADA

Recommended reading