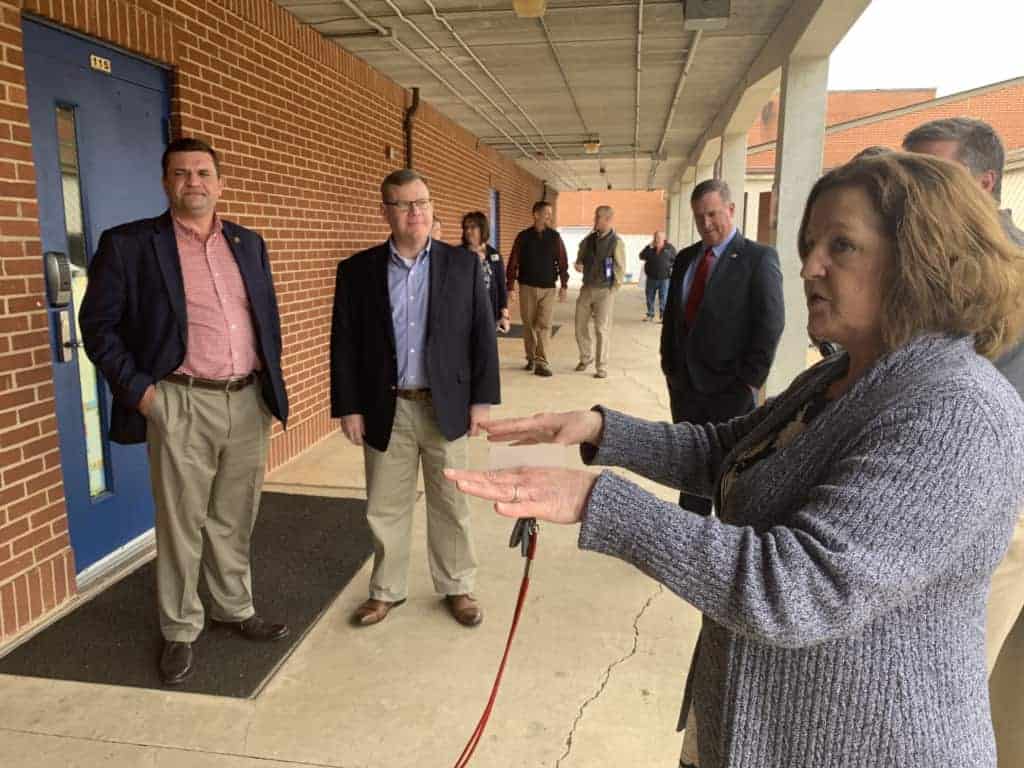

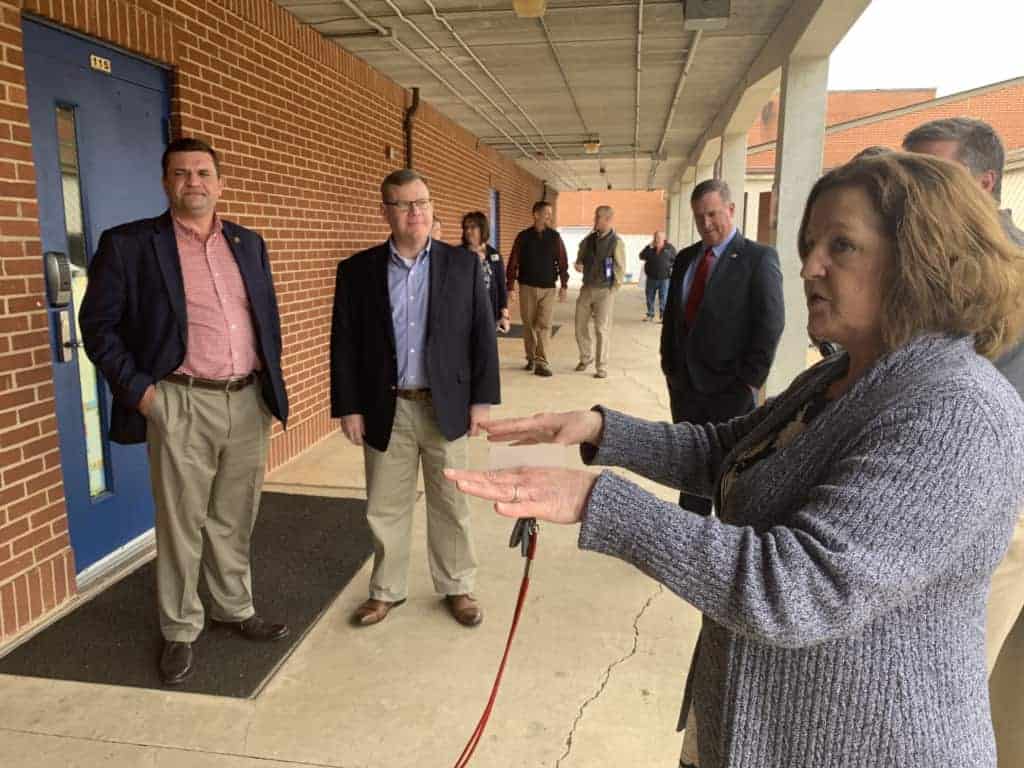

North Carolina Speaker of the House Tim Moore, R-Cleveland, and Rep. Jeffrey Elmore, R-Wilkes, toured Mt. Pleasant Elementary in Ferguson Friday to talk about a NC House school bond proposal that would appropriate $1.9 billion for school construction, renovations, and repairs.

“I’m traveling around the state — the west, the east and north, south — wanting to see school districts in the rural areas and the urban areas to really go through and see a lot of the needs that we know are out there,” Moore said. “And then, more importantly, to get input from the communities about what we can do at the legislative level to help particularly on the school construction bond but also on other issues of education policy.”

The tour stop occurred just days after an alternative proposal from Senate Republicans was voted through its first committee. The Senate proposal, a so-called pay-as-you-go plan, would aim to inject $2 billion for school construction by using money from the State Capital Infrastructure Fund, a new pot of cash the state will start filling this year.

The fund was established in the 2017 budget and will receive 4 percent of state tax revenue and other money. Under the pay-as-you-go proposal, that amount would increase the fund contribution to 4.5 percent of tax revenue, and would allow schools to use some of the money for school construction. Senate proponents say their plan will result in allocation of the money over nine years without the state having to take on debt. The House proposal would leverage debt availability and allocate the funds over 10 years.

Moore believes the guarantee of money that comes under his school bond proposal is a better way to fund school infrastructure improvements, particularly in rural communities.

“A bond proposal gives you guaranteed money that you know you’re going to get,” he said. “The Senate proposal, which has merit, is simply saying that for future budgets, that the state’s going to budget that money. Well, this General Assembly that’s in session now can’t bind a future General Assembly. And another General Assembly could come in and say, no, we’re going to spend that money somewhere else. So there’s not a guarantee of that money at all. It’s just a hope.”

Elmore said the lack of certainty in budget funding could be especially challenging for rural communities which would not have the funds to cover construction obligations taken in Year 1 if the pay-as-you-go funds are not distributed for the entirety of a construction contract.

“From a rural community, we’re not experiencing a lot of growth,” he said. “If you create a budget hole at the local levels, without guaranteed money flow, it could dramatically affect local tax rates and that structure, when they’re already strained as they are because we’re not experiencing massive growth. And I think that’s true all over North Carolina. So [the bond] creates financial stability on all levels of the tax structure from the local all the way up.”

Moore’s visit to Wilkes County drew a smattering of local residents, a handful of whom challenged him and local officials on issues ranging from unrelated tax cut implications to equitable distribution of school bond money. The challenges didn’t surprise Sharron Huffman, vice chair of the Wilkes County Board of Education.

“We have a very, very, very conservative county,” Huffman said. “When you start talking about taxes, it doesn’t matter what it is, there’s opposition.”

The school bond, proponents say, would not require an increase in taxes, and leveraging available credit would not impact the state’s credit rating. In fact, they say that a pay-as-you-go plan could have more impact on local taxes if a future Assembly did not follow through on budget projections after a local district entered construction contracts.

“I don’t want to see the idea of the bond become a conservative/liberal type thing,” Elmore said. “This is about what makes financial sense and you can ask any small business owner — when you can leverage credit in your credit availability, you utilize it. Because you’re utilizing something. There’s nothing wrong with taking on a certain amount of debt, if you’re capable of doing it, especially on capital. And you don’t want to jeopardize personnel in the future because you don’t have proper financial plans. And I think if you talk to any small business owner on their operations to their business, they would tell you the exact same thing.”