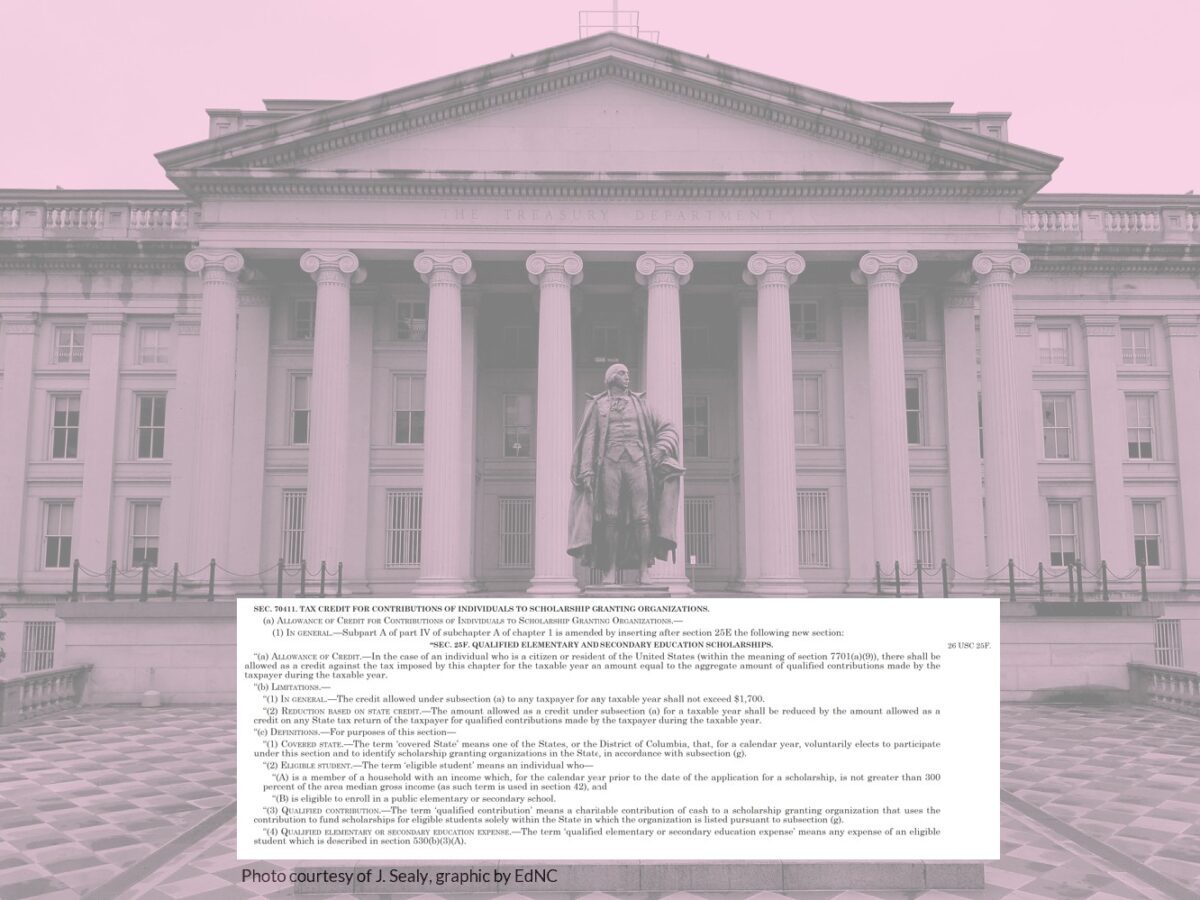

The U.S. Department of the Treasury and the Internal Revenue Service have issued this 21-page Notice 2025-70, requesting comments on the implementation of a “tax credit for contributions of individuals to scholarship granting organizations,” included in Sec. 70411 of the federal budget reconciliation bill. The bill was signed into law by President Donald Trump on July 4, 2025.

“Beginning Jan. 1, 2027, individual taxpayers may claim a nonrefundable federal tax credit for cash contributions to Scholarship Granting Organizations (SGOs) providing scholarships for elementary and secondary education expenses. The credit allowed to any taxpayer is limited to $1,700,” says a press release. “This new credit applies to contributions to SGOs that serve elementary and secondary school students from low- and middle-income families.”

The notice says the Treasury and IRS intend to propose regulations to implement the law. Interested stakeholders are urged to comment on the issues that need to be addressed in the regulations.

![]() Sign up for the EdDaily to start each weekday with the top education news.

Sign up for the EdDaily to start each weekday with the top education news.

For contributions to an SGO in North Carolina to be eligible for this credit, the state must first choose to participate.

A North Carolina bill, House Bill 87, called the “Educational Choice for Children Act,” would enroll the state in the federal tax credit program. It passed the N.C. General Assembly on July 31.

On Aug. 6, Gov. Josh Stein vetoed the bill, saying that while he supports school choice, he does not agree with funding private school choice initiatives while “cutting public education funding by billions of dollars.”

“However, I see opportunities for the federal scholarship donation tax credit program to benefit North Carolina’s public school kids,” said Stein. “Once the federal government issues sound guidance, I intend to opt North Carolina in so we can invest in the public school students most in need of after school programs, tutoring, and other resources.”

The bill has since been calendared five times by the legislature, but votes to override the veto have yet to be taken.

HB 87 would authorize the North Carolina State Education Assistance Authority (NCSEAA) to submit a list of qualifying SGOs to the federal government annually.

Any comments may be submitted, but the Treasury and IRS invite comments on the following issues:

A participating State’s required annual certification of SGOs within the State that meet the statutory requirements to qualify as an SGO;

Policies and procedures implemented by electing States to ensure that the required certification is accurate and complete;

Issues involving single-State organizations, organizations that may fundraise and award scholarships in more than one State, and organizations operating under other fact patterns that may wish to qualify as SGOs; and

SGOs’ reporting and recordkeeping requirements.

— Federal press release

To comment, use the Federal e-Rulemaking portal. Type IRS-2025-0466 in the search box. You will have the opportunity to comment, attach files, and indicate if you are an individual, organization, or prefer to comments anonymously.

Comments are due by Dec. 26, 2025.

Recommended reading