Note: This story was originally published on June 3, 2019. It has been updated to reflect the launch of the 2020-2021 FAFSA form.

If your or your family’s financial situation has changed significantly from what is reflected on your federal income tax return due to COVID-19, you may be eligible to have your financial aid adjusted. Click here for answers to FAQ’s about COVID-19 and the FAFSA from the U.S. Department of Education’s Office of Federal Student Aid.

Every student pursuing education after high school should fill out the FAFSA, or the Free Application for Federal Student Aid. The FAFSA isn’t one single loan or grant — its an application that, when completed, gauges how much help you will likely need to pay for college and connects you with resources.

The process may seem intimidating, especially for first-timers. But it’s a huge mistake to skip the FAFSA, regardless of your or your parents’ income. For the cost of 30 minutes to an hour, you could receive anything from loans with good interest rates to grants and scholarships that never have to be repaid. Some students receive enough aid that they pay next to nothing for a college education. And the form applies to much more than four-year universities. You can get aid for community colleges and other institutions like trade schools.

April Query, a regional representative for the College Foundation of North Carolina (CFNC), helps many students and parents fill out the FAFSA each year. I consulted her for expertise on the process while writing this article.

“The FAFSA is huge,” Query said. “When I give presentations, I start it out by saying, ‘There are two things you need to do to apply for financial aid. Fill out your FAFSA and apply for scholarships.'”

Although the FAFSA is technically a federal application, it can also net you financial aid from non-federal institutions. Colleges use the form to determine student need and offer their own help accordingly. To access those resources, you’ll need to fill out the FAFSA. So first, let’s talk about when you should fill out the form. The short answer: as early as possible.

DEADLINES

Financial aid from the federal government is given on a first-come, first-serve basis. That means the earlier you complete the FAFSA, the better your odds of receiving aid. Put another way, the government has a finite amount of money to give prospective students. If you wait too late, the funding that should have been yours could already be given to someone else — even someone who needs it significantly less than you do.

“Some of the programs run out of money faster than others,” Query said. “They only have so much to offer.”

The federal deadline to complete FAFSA for the fall semester is June 30. However, you should complete the form far earlier. Treat this as an absolute last resort. Public colleges in North Carolina like UNC-Chapel Hill, North Carolina State University, and East Carolina University have an earlier FAFSA deadline of March 1. At Duke University, it’s February 1 for regular decision students.

But even if these deadlines have already passed, it’s still worth filling out the form to see what you can get. Here’s how.

PART 1: CREATE YOUR FSA ID

Once upon a time, the FAFSA was a physical paper form that was mailed to the federal government upon completion. If any errors were found in your form, it would be sent back to you for changes and have to be mailed once again. While the government technically still accepts those forms, there’s no reason to use them. Submitting online is faster, easier, and more accurate.

Head to fafsa.gov to get started on your application. You’ll first need to create an FSA ID. This is the account that you’ll use to electronically sign your FAFSA. Every student applying for aid will need his or her own FSA ID. If you are considered a dependent student, then one of your parents needs an FSA ID as well. That means there will be two FSA IDs per household: one for the student and one for a parent.

“You literally already have about a third of the FAFSA process over with if you already have your FSA ID,” Query said.

PART 2: THE APPLICATION

Once you login with your FSA ID and choose to begin a new application, you’ll be prompted to create a Save Key. This allows you to take a break from working on the application and continue later. Make sure you write down or remember your Save Key to avoid losing progress. Before taking a break, make sure to click “Save” in the top menu bar of the application.

The FAFSA contains the following sections:

- Student Demographics

- School Selection

- Dependency Status

- Parent Demographics

- Financial Information

- Sign & Submit

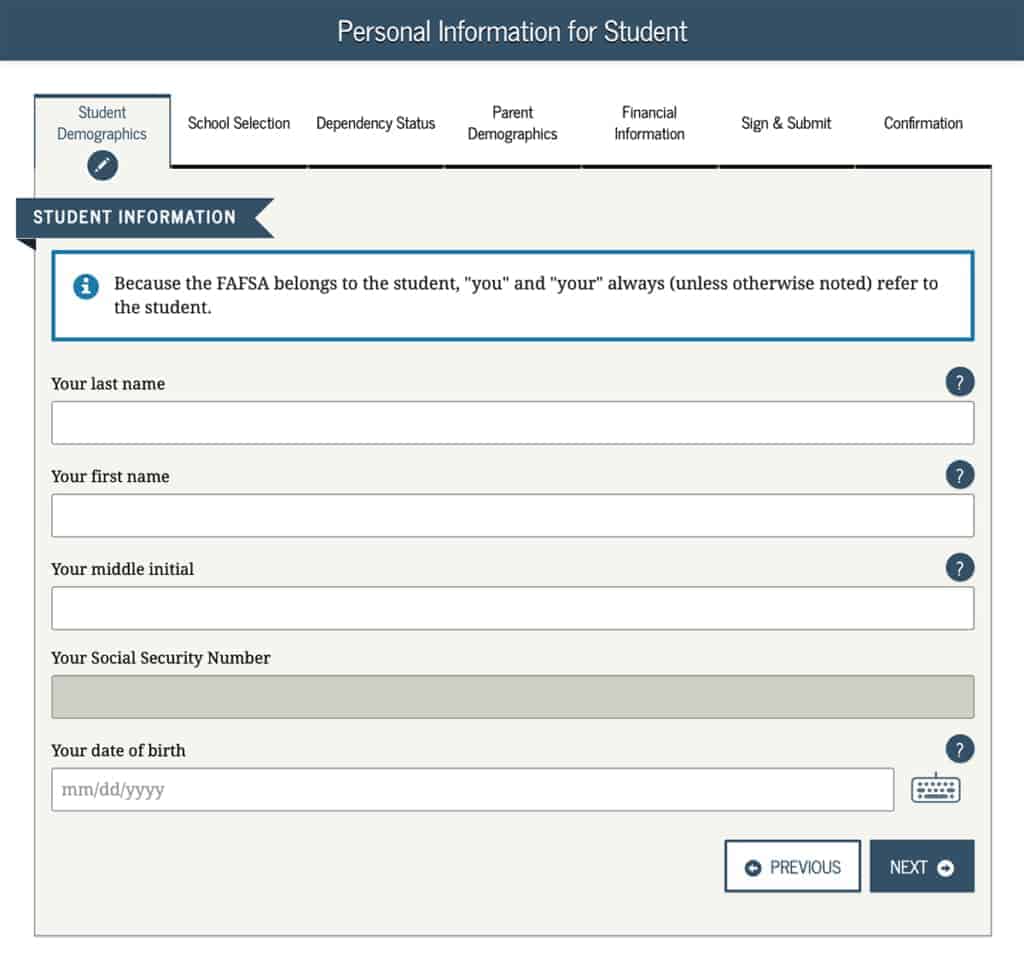

In the student demographics section, you’ll need to enter personal information such as your social security number, birth date, gender, residency information, graduation status, education history, and more. You’ll also be asked if you’d like to be considered for a work-study program, which is a part-time job — ideally one that relates to your field of study. Query recommended always answering yes to this question since you can decline the job offer later.

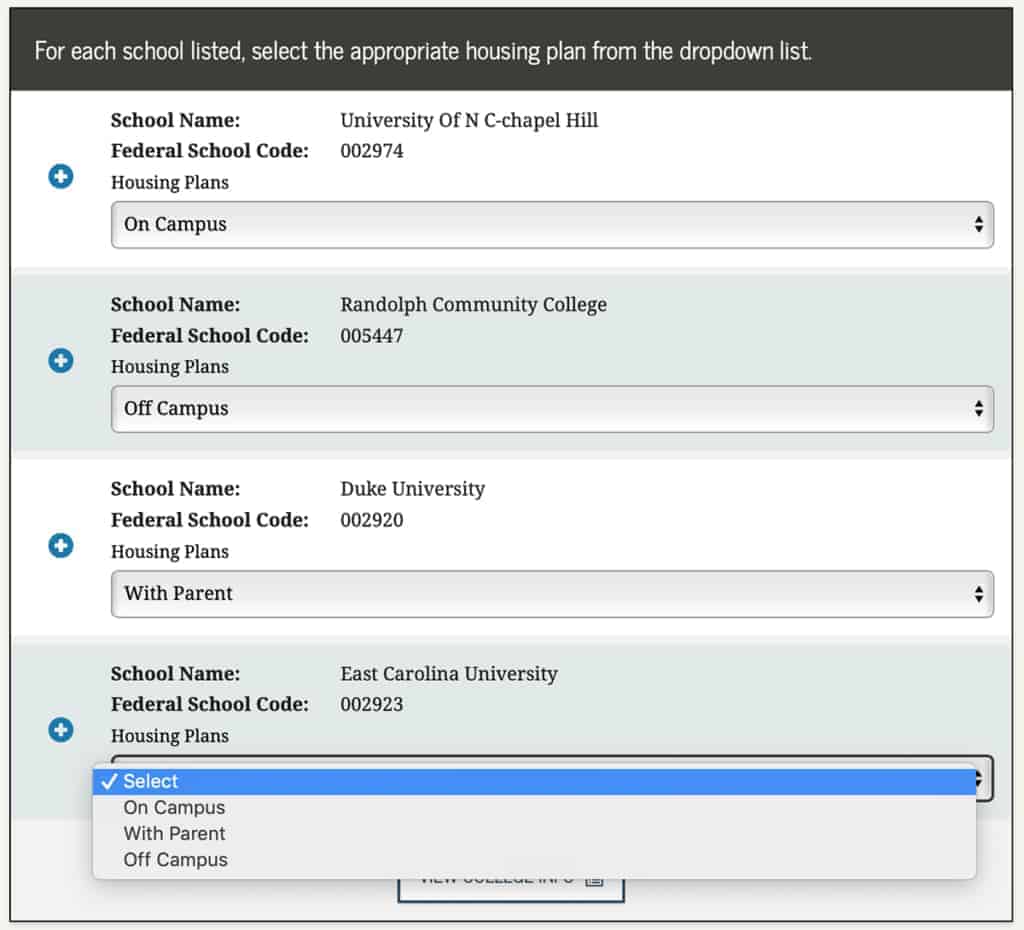

Next up is school selection, where you’ll search through a database for the colleges you’re interested in attending. You can choose up to 10 schools, and it’s important to select all your potential options since this opens you up to state-level aid. After you finish selecting schools, you’ll be asked to select what housing situation you’d be living in for each of them.

Moving on, the dependency status section is relatively short. It contains questions about your living situation, like how many dependents you have (children, for example) and how many of the other people in your household are currently attending college.

After that is the section on parent demographics. You’ll only need to complete this section if you qualify as a “dependent,” which is based on your answers in the previous section. You’ll enter a name and social security number for your parent(s) along with birthdays and potential other information depending on their marital status. This section also includes information about any siblings or half siblings you may have.

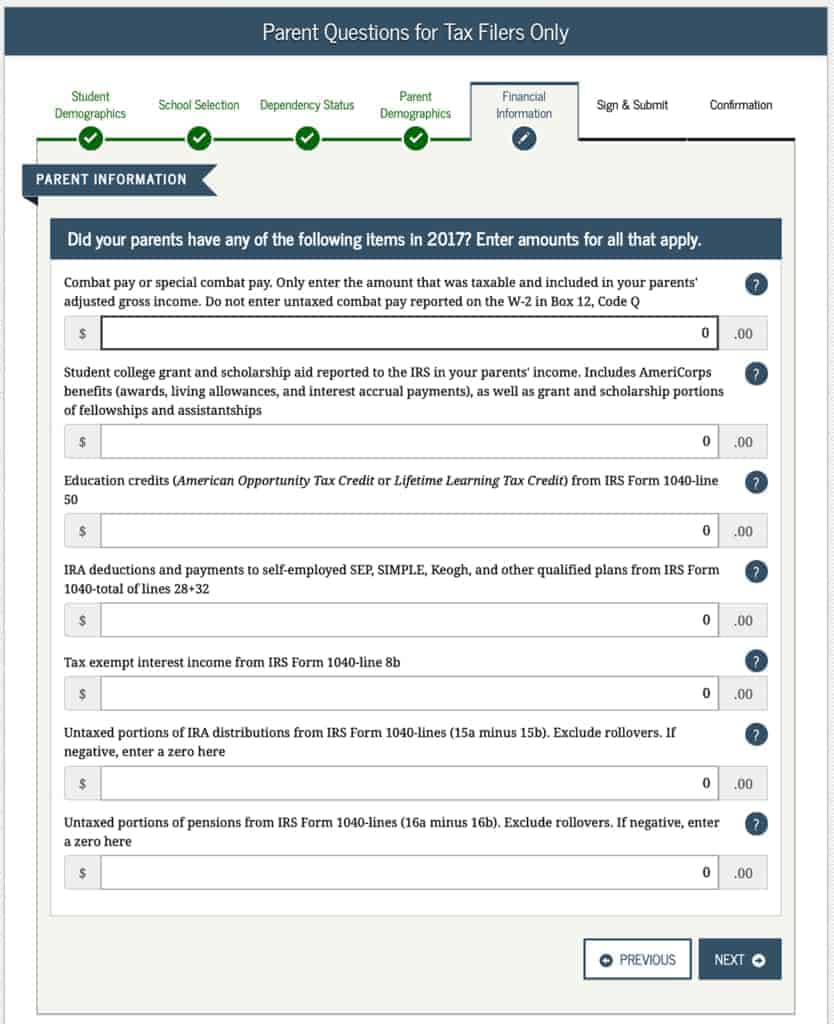

We’ve finally arrived at the final, and possibly most time-consuming, section of questions — financial information. For this part of the application, you can use the IRS Data Retrieval Tool, a feature embedded in the FAFSA application, to securely autofill a significant portion of your tax and income information directly from the IRS. Query told me one of the tool’s benefits, aside from its convenience, is improved accuracy.

“We’re all human, and we can fat-finger anything we’re typing,” she said. “The data retrieval tool takes out some human error.”

The questions will vary slightly depending on if you are considered a dependent or not. If so, you will be asked to submit your parents’ financial information. If you are classified as independent, you will only be asked to provide your own financial information. Either way, it’s a good idea to grab a copy of your or your parents’ 1040 and W-2 tax forms from the previous year. For example, the FAFSA for the 2019-2020 school year launched in October 2018. That means you would actually need tax information from 2017. Typically, the questions in this section of the FAFSA direct you to the exact part of the tax document you need to reference.

If for some reason you cannot use the IRS Data Retrieval Tool, you’ll be prompted to enter the information manually. Some questions may need to be entered manually regardless. Expect questions on the amount of money you or your parents have in savings, untaxed income, and more niche cases such as child support or combat pay. Query said you may need to reference financial records beyond tax forms, including bank statements, investment records, or other records of money earned.

PART 3: SIGNED, SEALED, DELIVERED

Once you’ve submitted all the necessary financial information, it’s time to sign and submit your FAFSA! This part is very simple — you simply click a button to sign the form using your FSA ID. If you’d rather, you can print a page, sign it using your real signature, and upload a photocopy. After your submission is confirmed, you can return to the form in the future to make changes by logging in with your FSA ID.

At some point after submitting your FAFSA, you’ll receive a letter indicating the type of financial aid, if any, you can accept. This is based on an estimate called the Expected Family Contribution (EFC), which denotes the amount the government expects your family can afford to pay toward college. Query said EFC starts at $0 and goes up from there, but it doesn’t always reflect the exact amount you’ll need to pay out of pocket. It can vary depending on different factors including which school you choose to attend or which scholarships you get.

“If you have a zero EFC,” Query said, “that means you should qualify for maximum needs-based grants as long as you did your FAFSA nice and early.”

If you qualify for a work-study program, you’ll have the chance to accept a part-time job at your institution that will allow you to earn a set amount of money. But two of the most commonly-offered types of financial aid are grants and loans. Grants are fairly straightforward: they’re an upfront monetary offer that can help cover tuition, room and board, or other school-related materials. Federal loans, on the other hand, must be repaid after graduation. But these loans are designed specifically for students pursuing higher education and offer advantages that may be harder to find in the private sector.

“[Federal student] loans have fixed interest rates, and there are also a lot of different repayment options that are connected to your income and what type of position you might hold,” Query said. She also said these loans include a potential to qualify for public service loan forgiveness, but the rollout of this program has been shaky at best and you probably should not depend on it. The loans also do not require a credit check, at least for students, and offer a six-month grace period after graduation.

Other financial aid tips

Since the tax information that the FAFSA relies on can be quite old, more recent income changes such as a divorce or career switch won’t always be reflected in the data. For these specific situations, Query recommended contacting financial aid officials at your high school or the institution where you’re planning to enroll. She said many high schools host “financial aid nights” where families can have their more personal questions answered.

“To find a resource with how to help you with that, sometimes your school counselor will know those answers,” Query said. “If not, they should always be in touch with the financial aid offices that you’re looking at, at least one of them — like the community college, for example.”

In the case of a divorce that occurred within the past year, Query noted that students could get approval to use more recent income information for their FAFSA. In this case, however, they would need to enter the data manually rather than using the IRS Data Retrieval Tool. Navigating these special cases are another good reason to fill out the form early — it can make the difference between getting the aid you need or missing it.

In addition to completing the FAFSA, Query stressed the importance of applying for scholarships, noting that scholarship money can help bridge the gaps your federal aid may leave. Living with parents while attending college also offers the potential to save an enormous amount of money. And North Carolina has a few grant programs you’re automatically entered into by completing the FAFSA, including grants designed for public universities, private universities, community colleges, and scholarships.

Some institutions, such as UNC-Chapel Hill, require incoming students to fill out another form called the CSS profile to become eligible for financial aid. Unlike the FAFSA, this form is not free, but it’s very important to complete if your institution requires it. You can consult this table to see whether or not you’ll need to fill out the CSS profile when you’re finished with the FAFSA. Your safest option, however, is always to check with the institution itself.

“It’s vital to visit your college’s website,” Query said. “Look for the financial aid section, read, ask questions.”

Recommended reading