Often when the U.S. or state governments offer an allowance, tax credit, or assistance program, it comes with many strict requirements, restrictions, or layers to the process of applying and receiving such resources. The outcome: families with the most needs don’t receive the supports that can help lift them out of poverty.

With the introduction of the American Rescue Plan (ARP), we saw the distribution of the Child Tax Credit (CTC) shift from a once-a-year refund, at tax time, to an expanded refundable monthly tax credit going to more families that had never qualified before.

This was a powerful tool for closing gaps in equity and addressing the vital needs of children and families during a crucial point in their lives: early childhood. Not only that, it steadied the wheel during a tumultuous time for so many families. However, this is needed more and all the time, not just in times of crisis.

The difference during crisis

Before 2021, 27 million low-income children were excluded from the full CTC. Families earning below $2,500 annually received nothing, while wealthy families got the full $2,000 credit. The ARP temporarily closed this gap for one year. For those with children, the ARP increased the CTC from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families would get the full credit if they made up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household). Whereas before only a certain range of parents qualified (those who earned enough to file taxes), with the expanded CTC, the lowest-wage workers finally also received a supplement.

No proposal for a child tax credit that would provide monthly income to the lowest-income families had reached the level of House consideration until a temporary version was included in the American Rescue Plan Act and then a permanent version in the proposed Build Back Better Act. The ARP concluded and the Build Back Better Act did not move forward. We saw reporting from The New York Times outlining the impacts and stories of the impact of the CTC and how the expanded safety net drove a sharp drop in child poverty.

Why wouldn’t the neediest families get assistance from the government? Why are the ones struggling, with the most constraints, being put to the test in order to get the help they need to best care for themselves?

As the years have gone on and more hardships have been imposed upon families and caregivers, from pandemic shutdowns to the loss of loved ones, layoffs, inflation, supply chain issues, and more, families — especially families in need — need more assistance, not less. There’s the emotional, physical, and financial cost of all this hardship. As an August Brooking Institution piece put it, “It’s getting more expensive to raise children. And government isn’t doing much to help.” Earlier this year, we at the North Carolina Early Childhood Foundation posed the question, “Is having a child in America becoming an unattainable privilege?”

Many rich countries — including France, Germany, Ireland, the Netherlands, and Sweden — already implement a “universal child benefit,” or a basic income going only to families with children. The best rationale for universal child benefits is that they substantially reduce child poverty. Yet, the United States still lacks such an approach, and states like North Carolina have restrictions on their Temporary Assistance for Needy Families (TANF) programs.

Why doesn’t the United States, or even North Carolina, do more to help stabilize and support those with the most need?

Some Temporary Assistance for Needy Families

The Child Tax Credit has gotten much attention over the past few years, but Temporary Assistance for Families (TANF) is also a resource that can be utilized. TANF cash assistance can play a critical role in supporting families during times of need. It replaced Aid to Families with Dependent Children (AFDC), which provided cash assistance to families with children experiencing poverty.

Governmental support for families in poverty already falls short of need. The TANF program, which is time limited, assists families with children when parents or other responsible relatives are unable to provide for the family’s basic needs. TANF reaches far fewer families and provides less cash assistance to families than AFDC, leaving more families in deep poverty.

Mapping North Carolina’s poverty rate by county shows a higher rate of North Carolinians below the poverty line in rural northeastern and southeastern areas. The latest five-year figures from the 2016-2020 American Community Survey reveal 14% of North Carolina residents overall earned incomes below the federal poverty line ($12,760 for a single person in 2020).

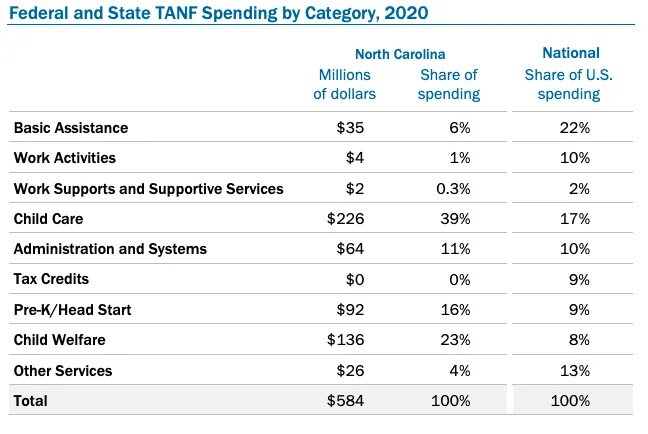

The percentage of families in poverty receiving cash assistance through the federal TANF program has declined since the program was enacted in 1996, according to a Center on Budget and Policy Priorities (CBPP) report released earlier this year. State rules vary greatly in how families qualify for the aid and how easily families can apply, meaning access to the program can depend on where a family lives. States have shifted the funds that previously went directly to families to fund other programs. A North Carolina TANF Spending overview gives a breakdown of this, as shown below.

With restrictions on how, where, and when to access assistance, moms raising kids in poverty often stay stuck in the cycle before they can fully stabilize, as this August 2022 North Carolina News & Observer article story shared.

Who qualifies for cash assistance in North Carolina?

TANF cash assistance is only available to families with very low incomes that have children. Families that meet eligibility criteria, including the following, may qualify for emergency assistance:

- The family must have a child below the age of 18 who lives with a relative as defined for Work First Family Assistance.

- The family’s total income must be at or below 200% of poverty level.

- The family has proof of identity and citizenship.

Generally, parents and caregivers of children in child-only TANF cases are not mandated to engage in welfare-to-work activities (where beneficiaries are required to work in order to qualify), and few states offer these adults any of the work supports — child care, employment training, work placement, transportation assistance. But in North Carolina, there is a work requirement, even when these are people living and working in poverty.

“Our state spends very little on direct cash assistance. A large portion of TANF dollars are used for child care subsidies, which we know are really beneficial for families and for helping parents work, but North Carolina could use state funds for these subsidies and prioritize TANF funds for cash assistance” said Logan Rockefeller Harris, a senior policy analyst at the NC Budget and Tax Center (NC BTC). “By giving states so much flexibility, there are definitely plenty of cases where TANF spending doesn’t have a direct benefit for the families that it’s supposed to be serving.”

From Work First Family Assistance, NC Department of Health and Human Services:

“North Carolina’s Temporary Assistance for Needy Families (TANF) program, called Work First (WF), is based on the premise that parents have a responsibility to support themselves and their children.

The Work First program promotes a strengths-based, family-centered practice approach and shares in the mission of the NC Department of Health and Human Services, in collaboration with its partners, to protect the health and safety of all North Carolinians and provide essential human services.

Work First provides parents with short-term training and other services to help them become employed and move toward self-sufficiency. Families in which grandparents and relatives are caring for their relative children and legal guardians can receive services and support that prevent children from unnecessarily entering the foster care system.

Work First emphasizes three strategies: Diversion, Work and Retention.”

TANF access & application complications

Since states decide how their share of TANF money is used, they also can create additional eligibility rules. In North Carolina, Work First families can get help for two years, but must wait three more years to reapply. The lifetime federal limit on benefits is five years. Family size is capped, providing no additional benefits for children born while a family receives help, and people with drug felonies, undocumented immigrants, and children with Social Security benefits can be excluded.

The federal minimum wage, which is also the rate North Carolina uses, has remained set at $7.25 an hour since 2009, and the Wall Street Journal reported in summer 2022 that it now costs $300,000 to raise a child. There is a wide gap between making $7.25 an hour and being able to provide a good quality of life for a child, at the supposed $300,000. There is also a lot of red tape around who can qualify for and how to actually get TANF.

From the CBPP:

“While some families leave TANF because of employment, many others leave because their benefits were taken away due to time limits or sanctions. Research shows that states often apply sanctions inappropriately to parents facing significant barriers to work, such as people who have physical and behavioral health issues, are fleeing domestic violence, or have low levels of education and limited work experience. TANF parents may also face significant logistical challenges, such as lack of access to (or funds to pay for) child care and transportation.“

TANF assists parents who aren’t currently able to work for pay or have very low incomes — many of whom are susceptible to housing instability, especially during periods of crises, such as when they lose a job or flee from domestic violence. Financial hardship and stress may increase the risk of domestic violence, making TANF a critical program to help survivors.

The rules reinforce racial and gender biases, attempting to control women’s choices. These reflect a foundation in slavery and Jim Crow, the CBPP report outlined, in which reproduction and labor have been used “to exploit control and punish” Black women for economic gain. In particular, TANF programs increased the number of Black and Hispanic children in deep poverty, the report said.

In addition, some states have restrictions on accessing government assistance programs, for those with criminal records. North Carolina, for example, bans people with prior felony drug convictions from eligibility for basic needs programs for six months after the completion of a sentence. These modified bans still impede the ability of people with convictions to successfully reenter society.

Applications are provided and processed by local Departments of Social Services (DSS) offices as well as the Employment Security Commission. Each of North Carolina’s 100 counties has a local social services agency, which means the application process varies widely, and someone pursuing TANF Work First Assistance would have to locate their phone numbers, websites with application details, and possible physical or mailing addresses, rather than having one central source to apply from.

Both government agencies partner to calculate the monthly payment amount, averaging around $300 depending on family size. They also address personal responsibility and approve what bills and household expenses can be paid by North Carolina Work First. Considering the rising cost of living and that it’s only available to lower income working people, it’s really not a significant amount of money for an allowance that is so restricted and scrutinized. The TANF cash assistance payment amount has not been tied to the cost of living or adjusted for inflation since its inception. The payment level is the same as it was before the Work First program was created in 1995 — so the amount of buying power is negligible compared to nearly 30 years ago.

As mentioned, it’s also not a straight-forward application, adding to the list of channels someone struggling may pursue at multiple levels when looking for assistance at the local, county, state, or federal level. The TANF Work First Benefits application can be found online.

“In North Carolina, also, things are just very devolved to the county level, like with social services. Sometimes it’s more regional,” Harris said. “Those kinds of departments have control over what the application is like and experience is like for somebody trying to access the benefits.”

In North Carolina and South Carolina combined, some 158,000 children live with kin caregivers, defined as relatives or non-related adults who share a strong connection to a child. These kin caregivers step in when biological parents are unable or unavailable to take care of the child. These arrangements have been known to produce better outcomes for children than non-familial placements, but kin caregivers often receive less assistance from child welfare agencies than foster families.

How could the CTC & TANF improve to benefit families?

Mounting evidence suggests that early hardship leaves children poorer, sicker, and less educated as adults, so it’s really important for that early childhood foundation to be well-supported across the spectrum. With that in mind, it’s imperative that public policy addresses poverty. Whether it’s food, care, education, housing, health care, or other matters that influence social determinants of health, we all want to see families and children happy and healthy, to lead to brighter futures.

The Child Tax Credit was mostly an automatic benefit, but exclusive to certain tax brackets, and Temporary Assistance for Needy Families has not reached as many folks as it could surely benefit.

TANF is ultimately underutilized, with many eligible children and non-parent or kin caregivers who could benefit yet are not enrolled. Despite an apparent aversion to marketing TANF, TANF agencies may need to find ways to inform these potentially eligible families about the availability of child-only benefits and facilitate their enrollment.

Harris, from NC BTC, noted an opportunity to streamline the application process. In fact, streamlining the application processes across and within programs is a tactic mentioned by the Center for American Progress in how to get rid of administrative burdens of accessing benefits. What if someone struggling could provide all their background information and needs in one seamless application that could be used to assess whether or not they qualified for child care, food, health, housing, direct cash, or other assistance?

Too often, programs like the Child Tax Credit or Temporary Assistance for Needy Families remain in limbo or at risk of being eliminated, due to the lack of permanent program support.

Expanding the CTC

The 2021 Child Tax Credit pushed child poverty to the lowest level ever measured. For one year, there was an expanded, regularly accessible CTC to more families than ever before. The TANF has been due for reauthorization since 2010 but has only been temporarily extended every year since then. That’s constant unpredictability for the folks who crave stability the most.

The routine monthly CTC allowance in 2021 was more frequently distributed, accessible to individuals in a wider tax bracket range, and offered a larger amount, which greatly benefited families’ abilities to provide for ongoing regular needs, as well as plan and save for future emergency or long-term needs. The NC BTC has an overview on how a North Carolina Child Tax Credit would help all children.

Strengthening TANF

As another Brookings piece put it, “To target aid to the neediest families, we need to strengthen TANF.” To improve access to the program, states can lift income thresholds and asset limits for applicants, remove barriers to access for those seeking cash assistance, and stop implementing punitive policies such as sanctions and time limits that take away benefits from families even when they continue to need assistance.

When you look at the purpose of TANF in federal legislation, it is clear that the first purpose is to help children to be cared for in their own homes or the homes of relatives. The actual language states:

The purpose of this part is to increase the flexibility of States in operating a program designed to—

1. provide assistance to needy families so that children may be cared for in their own homes or in the homes of relatives;

2. end the dependence of needy parents on government benefits by promoting job preparation, work, and marriage;

3. prevent and reduce the incidence of out-of-wedlock pregnancies and establish annual numerical goals for preventing and reducing the incidence of these pregnancies; and

4. encourage the formation and maintenance of two-parent families.

There could be an opportunity to reimagine this program as a child maltreatment prevention program. With so much of TANF being spent on child welfare staff (CPS, foster care, and adoption) that will be hard, because North Carolina has never invested many state funds in child welfare. The other large source of funding for child welfare is Title IV-E (now known as the Family First Prevention Services Act) and it is a 50-50 match of federal funds with county funds. However, the state does not contribute.

States should do more under existing TANF policies to get domestic violence survivors the assistance and services they need to escape abusive relationships and rebuild their lives. More states can leverage TANF funds to help low-income families experiencing or at risk of housing instability or homelessness.

States can also redesign their work programs to help TANF participants gain the education, skills, and work experience that will allow them to find and maintain quality jobs that can lift their families above the poverty line. The NC BTC also has an overview on how an “increase in NC’s Work First cash assistance program would help families meet basic needs.”

What could be better than every family having the best, most equitable opportunities and experiences for a strong start to life?

Recommended reading