Editor’s note: We will continue to report on this throughout the day and will update this article as more information becomes available

Updated at 1:00 p.m.

In a phone interview, State Auditor Beth Wood said the findings in the audit are “extremely significant.”

“All agencies are responsible for their financial information, their financial statements, accounting for and reporting the transactions that run through their agency,” she said. “And this agency couldn’t prepare their own financial statements. It’s their responsibility and yet they could not.”

She referred to the first issue in the findings related to the Public School Insurance Fund. She said that for an insurance fund like this, it requires estimates of damage when it comes to a situation like a hurricane. Those estimates should be reported in the fund. But the state Department of Public Instruction (DPI) did not do so.

“So, it’s sort of fundamental,” she said.

Wood said that DPI had a separate insurance policy that covered hurricane damages, yet DPI didn’t record the money they recovered from that fund or the money they expected to recover. Because they didn’t correctly account for that recovered money, DPI overstated claims payable to school systems by almost $23 million.

Wood said these are basic mistakes, and that this inaccurate reporting makes it difficult for outside entities — like the General Assembly — to look at DPI’s financial statements and make accurate assessments.

“People have to react on and use information out of your financial statement to determine your financial stability,” she said.

When it comes to year-end accruals, Wood said DPI also made some basic mistakes. She said at the end of the year, revenues that you expect but haven’t gotten cash for, expenses that you haven’t written checks for — that all has to be shown. But she said DPI didn’t record “payables” for goods or services they received but hadn’t yet paid for.

Further, DPI calculated the change in the fair market value of their investments incorrectly. They collected about $20 million in civil penalty and forfeiture funds that they had to pay back out to school systems, but they never recorded that the money needed to go back out, making it look like they had $20 million more than they did.

“Some very fundamental stuff got missed,” she said.

Now that the mistakes in the financial statements have been pointed out, they have been fixed, and Wood said DPI’s financial statements are clean. But she said that the basic errors she saw raise all sorts of questions.

“Now it makes you wonder, whenever anything comes out of DPI to legislators or others, how accurate is the information given?” she asked.

In another example, Wood pointed out how DPI records their final budget versus original budget from the General Assembly. Legislators give DPI a budget and then it is changed throughout the year. It leaves them with an original budget — how much they were given by lawmakers — and a final budget, which is how much they actually spent.

On one document, there is a space for the original budget, the final budget, and then a column that shows whether DPI was over, under, or on budget. Wood said that when DPI prepared the financial statement, they transposed the number from the original budget with those of the final budget. That amounted to errors from $123.8 million to $695.4 million.

She said that’s a “big” error and “fundamentally elementary.”

In the response to the audit from state Superintendent of Public Instruction Mark Johnson, he laid out how the agency would correct the issues, including filling vacancies, training, and more. Here is a portion of his response.

“In order to correct deficiencies identified, DPI will provide additional staff training related to year-end activities, financial statements, and review procedures. DPI has filled key vacancies, and staff will review and reference the prior year audited financials to ensure completeness of information provided in the current year, compare current year balances to prior year for reasonableness, and ensure accuracy of note disclosures. The Finance Manager will review the progress of year-end activities and year-end reporting on a weekly basis. DPI is also working to reassign duties for a position to provide more support to the Accounting, Controls and Reporting section,” the response stated.

When asked for a comment, Graham Wilson, director of communication and information services at DPI, said the department’s response was summed up in the response attached to the audit.

“If they follow through with what they laid out in their response, I think you won’t see these findings next year,” Wood said.

SEE BELOW FOR ORIGINAL ARTICLE

Today at 10 a.m., the N.C. State Auditor released this audit of the N.C. Department of Public Instruction.

Here are the findings, recommendations, and responses:

The following audit finding was identified during the current audit and describes conditions that represent a deficiency in internal control.

FINANCIAL STATEMENTS CONTAINED SIGNIFICANT MISSTATEMENTS AND OMISSIONS

The financial statements, related notes, and required supplementary information prepared by the Department’s financial reporting staff and submitted for audit contained significant misstatements and omissions that were identified and corrected as a result of our audit as follows:

A. The Department did not recognize the financial reporting implications of a major hurricane on the Public School Insurance Fund’s (PSIF) financial statements. Specifically, the Department:

- Did not report a $7.1 million accounting estimate for hurricane-related claims expected from insured entities, but not formally filed, until prompted by the audit.

- Did not report amounts recoverable for paid and unpaid hurricane-related claims of $5.3 million and $32.1 million, respectively.

The hurricane event was covered by a reinsurance policy. Reinsurance transfers a portion of the Department’s risk of loss to other insurers. This resulted in recoveries for the Department. The estimated recoveries should be deducted from the related unpaid claims liabilities.1 The inaccurate accounting treatment for these transactions caused the PSIF claims payable balance to be overstated by $22.9M.

Also, the Department significantly miscalculated amounts presented in the risk management disclosure and Ten-Year Claims Development Information2 required by accounting standards. The disclosure further included an inaccurate statement that there had been no reinsurance claims during the year.

B. The Department’s year-end accruals were not prepared or not prepared correctly. Specifically, the Department:

- Did not recognize a liability for civil penalty and forfeiture funds3 being held for school districts.

- Failed to recognize a liability for federal revenues that were unearned because they were requested and received in advance of the related disbursement.

- Incorrectly calculated and recorded the change in fair market value for pooled investments.

- Did not record payables for goods and services received but unpaid during the year.

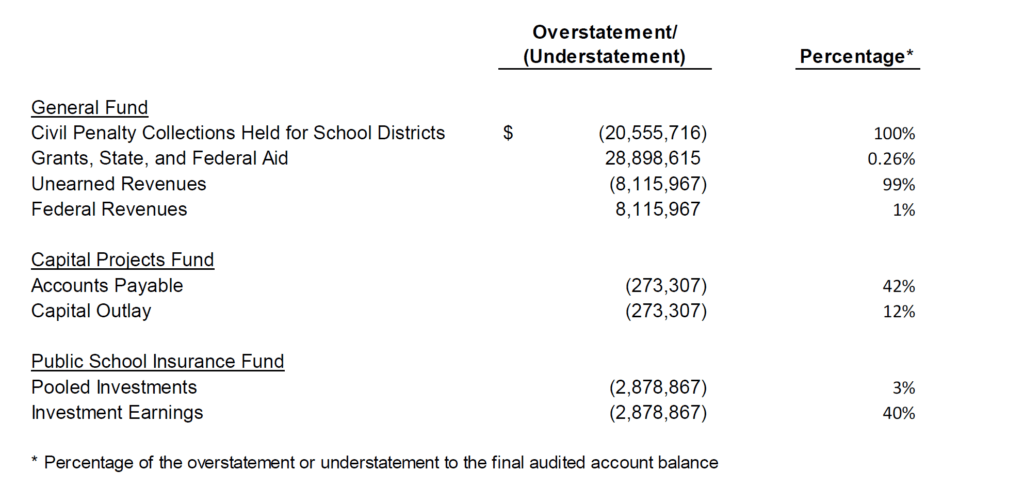

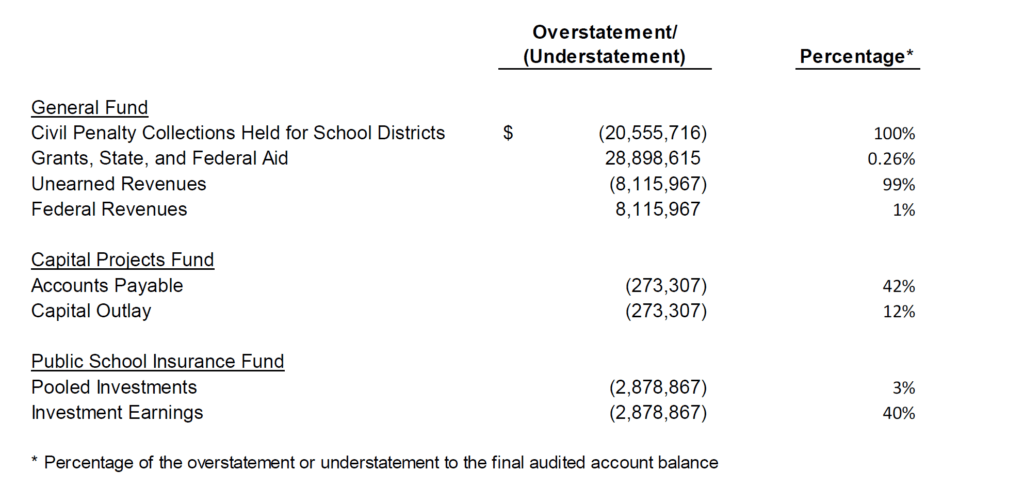

The following misstatements resulted from the errors noted above:

C. The Department made other significant errors in the process of compiling financial statements, note disclosures, and required supplementary information, including:

- The fiscal year 2019 Statement of Cash Flows (Exhibit B-3) presented fiscal year 2018 amounts and did not reflect other corrections made as a result of the audit. Cash Flow Statement errors ranged from $1.9 million to $22.8 million.

- Budgetary Comparison Schedule transposed Original Budget and Final Budget amounts as defined by the Governmental Accounting Standards Board (GASB)4 and did not agree to the underlying accounting records. The most significant errors ranged from $123.8 million to $695.4 million.

The notes to the financial statements, required supplementary information, and other supplementary information were incomplete and required numerous corrections.

Without these error corrections and inclusions of all required statements and disclosures, users of the financial statements could be misinformed about the Department’s financial condition, including sufficiency and flexibility of resources, asset performance, and operating results.

The omissions and errors in financial reporting occurred and were not detected and corrected, in part because:

• The Department did not possess sufficient and appropriate knowledge and training necessary for timely, accurate, and complete year-end reporting.

• The Department did not have an adequate year-end plan that would result in a complete and thorough review of the financial statements prior to submission for audit.

The Department did not adequately address the loss of institutional knowledge and expertise due to significant management and financial reporting staff turnover in recent years, especially as related to reporting for the Public School Insurance Fund.

The Department’s management is responsible for the fair presentation of the financial statements and related notes to the financial statements in conformity with accounting principles generally accepted in the United States of America. Additionally, best practices require management to periodically review and analyze financial information. The Government Accountability Office (GAO) recommends that senior management should regularly review actual performance against prior period results. The GAO also recommends that “financial and program managers review and compare financial, budgetary, and operational performance to planned or expected results” and that agencies be “especially attentive to risks caused by the hiring of new personnel to occupy key positions or by high personnel turnover in any particular area.”5

Recommendation: Management should ensure that:

• A knowledgeable individual, or group of individuals, perform a complete and thorough review of the financial statements and related information to ensure timely, accurate, and complete year-end reporting.

• Contingency plans are implemented to meet financial reporting objectives during periods impacted by staff turnover.

• Financial reporting personnel possess the required competencies and are adequately trained to perform year-end financial reporting.

Agency Response: See page 88 for the Department of Public Instruction’s response to this finding.

In the agency response, state Superintendent of Public Instruction Mark Johnson gave some explanations for how the issues happened.

“DPI concurs with the Auditor’s finding and recommendations. This was the first year that DPI was tasked with completing the standalone financial statements. DPI was proactive and contracted with a consultant who had prior experience with these financial statements to assist in preparing the statements and training staff members in the Accounting, Controls, and Reporting section. Unfortunately, audit adjustments in connection with fiscal year 2018 financials were never posted, which impacted the 2019 Cash Flow Statement and 2019 Annual Consolidated Financial Statements within the liabilities on the balance sheet and restatement of fund balance. This was not discovered until after the 2019 Financial Statements were completed,” he wrote.

He also said that DPI recommends that insurance matters be handled by the NC Department of Insurance. He said they can better handle “large volumes of claims due to hurricanes. He said staff of the Public-School Insurance Fund “did not accurately estimate all the possible claims caused by the historic event, which led to the issues identified.”

Here is the audit in full: