During its last meeting of the year, the State Health Plan (SHP) Board of Trustees discussed on Friday data from the open enrollment period, various benefit updates, and a status report on the plan’s financial footing following a series of changes implemented this year to reduce significant budget shortfalls. The SHP provides health care coverage to nearly 750,000 teachers, charter school employees, community college employees, other state employees, retirees, and dependents.

Ahead of the meeting, Tom Friedman, executive administrator of the SHP, said during a Monday press conference that the plan is now financially solvent.

“Following the changes by the (SHP) board and the action by the General Assembly, we are not going to be in a deficit for 2026 or 2027,” Friedman said. “We still have work to do, though.”

![]() Sign up for the EdWeekly, a Friday roundup of the most important education news of the week.

Sign up for the EdWeekly, a Friday roundup of the most important education news of the week.

Since last spring, the board worked to address an expected deficit of $500 million for the plan, which was estimated to grow to $1.3 billion by 2027. In May, the board approved several changes to plan benefits, and in August, the board approved increases to health care coverage premiums for members, which will now be on a sliding salary-based scale, effective in January 2026.

Now, while leaders say the plan is in a good financial position through 2027, they are closely watching data to ensure the plan remains solvent in 2028 and beyond. Specifically, they are watching the rise of medical costs in recent years, paired with plan revenue that has not kept up with those cost increases.

Medical costs are increasing at about 6% annually, State Treasurer Brad Briner said, while SHP revenue is growing at about 3%.

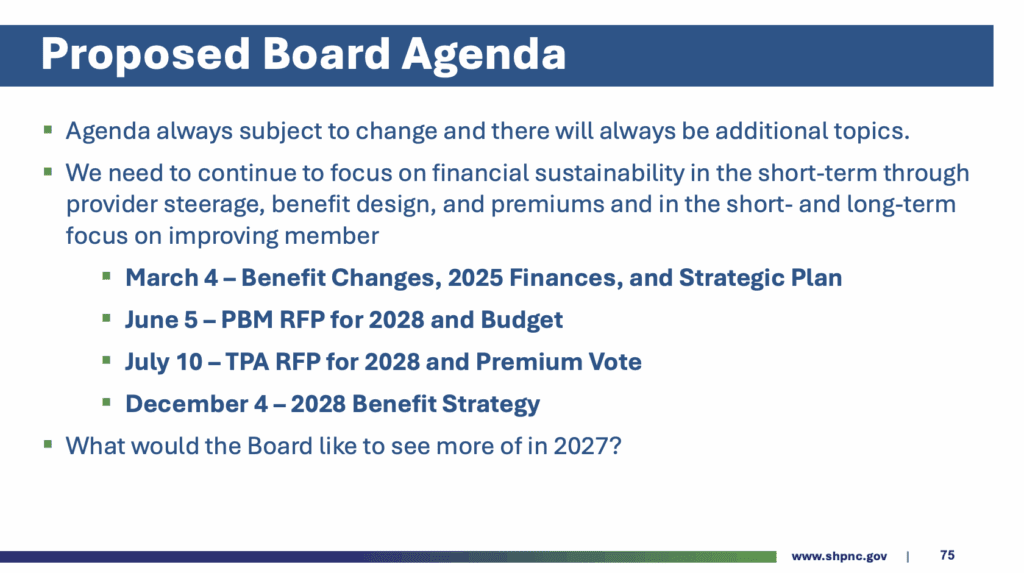

Moving forward, Friedman said he anticipates further benefit changes in 2027, to be voted on in March 2026. Any further premium changes would be voted on in August 2026. He said both would be smaller in “magnitude and scope” than the changes approved earlier this year.

Briner said on Monday that they intend to set SHP premiums as a fixed percentage of income in the future, rather than a dollar amount. Given rising health care costs, Briner said premiums are also likely to increase in the future.

“It is important for people’s budgeting that they know how much of their paycheck will go to health care, but it is equally unrealistic to expect that, on a dollar basis, that they never go up,” he said. “We have made very good progress in digging out of the hole, but as Tom said earlier… we have more work to do.”

Highlights from open enrollment, population survey

Open enrollment for active members of the SHP ran from Oct. 13 to Oct. 31, 2025, for benefits between Jan. 1-Dec. 31, 2026.

The SHP offers two Preferred Provider Organization (PPO) plans in 2026:

- The Standard PPO Plan (formerly known as the Base PPO 70/30 Plan)

- The Plus PPO Plan (formerly known as the Enhanced PPO 80/20 Plan)

For 2026, all members are automatically enrolled into the Standard PPO Plan. New this year, the plan is implementing salary-based premiums for 2026. Rates are based on an employee’s current, total salary at the time of open enrollment.

In 2025, members paid $25 for the 70/30 standard plan and $50 for the 80/20 plus plan. Starting in January, that will increase to $35 to $80 for the standard plan, increasing by salary bands, and $66 to $160 for the plus plan.

The premium costs for subscribers with children on their plan will now actually be lower for most members. Starting in 2026, only the highest-paid employees will pay more for the subscriber plus children plan.

This week, Friedman said there was a slight uptick in members choosing to enroll their children in the plan. Additionally, he said more people selected the plus plan, despite the higher increase in premium increases under that option. Lastly, he said fewer people left the 70/30 standard plan to go into Medicare Advantage than anticipated.

Here’s a look at open enrollment data in 2025 and 2026.

Friday’s presentation also included information on the SHP’s 2025 population risk report, starting on slide 19 of the presentation.

Medical risk scores have “increased significantly since 2019,” the presentation said, along with prescription drug risk scores. Medical costs for the plan have increased each year since 2019, while prescription drug costs were slightly lower in 2024 than when they peaked in 2023.

“One of the main factors driving year-over-year (YoY) medical costs have been mental health conditions, including neurodevelopmental disorders (e.g., ADHD and autism), anxiety disorders, depressive disorders and trauma disorders,” the presentation says.

Among other things, the presentation also includes information on urban versus rural trends, “catastrophic risk group” members, chronic conditions, diabetics and obesity, cancer, substance use disorder, and more.

You can view the full presentation here.

Benefit updates and financial status of SHP

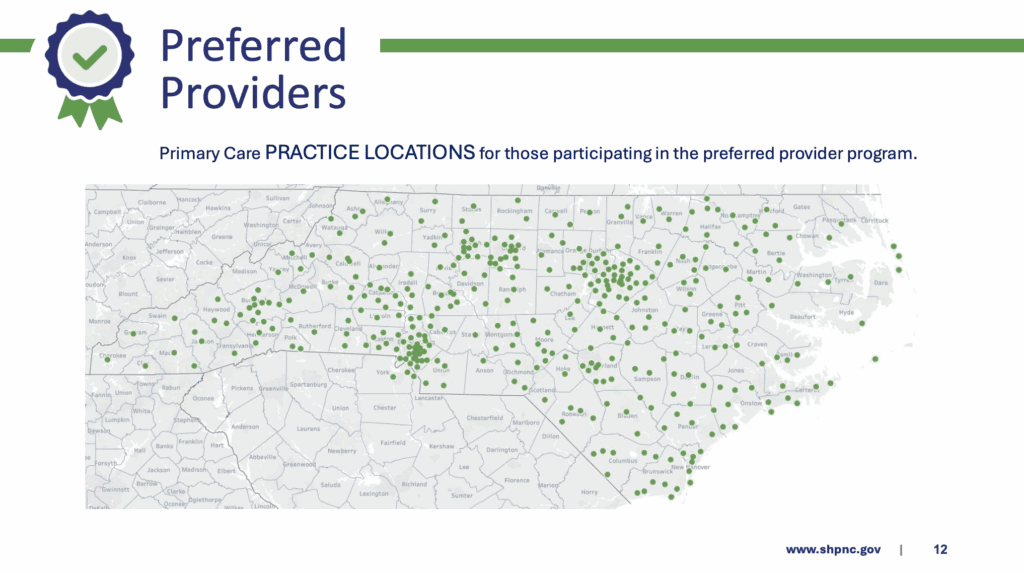

On Friday, SHP staff also gave updates on the number of preferred providers across North Carolina.

“When you look at the map, something I am exceedingly proud of is the depth and breadth of preferred primary care providers across the state of North Carolina,” Friedman said. “We don’t have access in every county to a preferred provider, but a lot of those counties don’t have very much access to anything at all. So it is not for lack of trying — it is for health care demographics more than anything else.”

The presentation shows that there are fewer OBGYN and specialist practice locations spread out across the state, though.

Staff also presented updates on several partners, including Hinge Health, Ventricle Health, Lantern Surgical Benefit, and Hello Heart. You can view those updates starting on slide 15 of Friday’s presentation.

Finally, on Friday, staff discussed the financial outlook for the plan. Despite benefit and premium changes made this year, the presentation says the plan’s cash balance is projected to fall below the target stabilization reserve of $427.5 million in January 2028.

With those trends in mind, the team outlined the following priorities for the SHP in the next year:

At the end of Friday’s meeting, Friedman said the SHP board must continue to increase price transparency, work with partners who want to help reduce costs, encourage members to attend lower-cost health locations, and reduce cost variations across the state.

“I hope what everyone is hearing is that we have work to do with our provider community and to create incentives to steer our members. We are not going to solve this through benefit changes alone,” he said. “This is a cost problem … and we have to drive those costs down so we can continue to invest in health. We have to do two things that are really hard at one time.”

Recommended reading