This article was originally published by the North Carolina State Education Assistance Authority.

Fear of student loan debt is a big obstacle to students not only going to college but also to filling out the Free Application for Federal Student Aid (FAFSA).

This is one of the findings from research commissioned by the North Carolina State Education Assistance Authority (NCSEAA) in 2023. NCSEAA, the primary sponsor of College for North Carolina, commissioned the research to better understand how to help students and families know about the Next NC Scholarship, a program that combines the Federal Pell and state grant into one easy to understand need-based award. To qualify, students must complete a FAFSA to access state and federal financial aid available to them.

“When you go to college, if you have that debt, maybe in the long run it’s preventing you from… buying a house,” one parent commented. “Yes, it could help you out, but at the same time, it could put you in debt.”

![]() Sign up for the EdDaily to start each weekday with the top education news.

Sign up for the EdDaily to start each weekday with the top education news.

Efforts to address concerns such as these are all the more important as partners around the state try to increase FAFSA completion to help the state meet its attainment goal of 2 million North Carolinians between the ages of 25 and 44 with high-quality credentials or postsecondary degrees by 2030.

Important findings

The research findings showed that students and parents are mostly positive about postsecondary education, but some parents remember the FAFSA as their first step on the road to student loans and life-altering debt. This, in effect, causes some families to closely identify FAFSA with student loan debt, rather than the many other forms of aid that don’t have to be paid back.

In the findings, parents closely related the FAFSA with only four-year universities and expressed skepticism about the value of the education those institutions provide when weighed against the possibility of going into debt. These parents often consider other educational paths as viable alternatives to the traditional four-year route.

“It’s important to make sure that people understand that furthering your education doesn’t always mean a university or four-year program,” one parent commented. “There are trade schools, there are certificate programs that you can enter and be just as successful.”

This perception is also coupled for some parents with the notion that the pursuit of certain degrees or careers doesn’t provide a good return on investment.

“The truth of the matter is a lot of times when you get education, it does not pay back,” one parent said. “We have so many students with degrees that are paying on loans, and they cannot get a job.”

Awareness and understanding of FAFSA

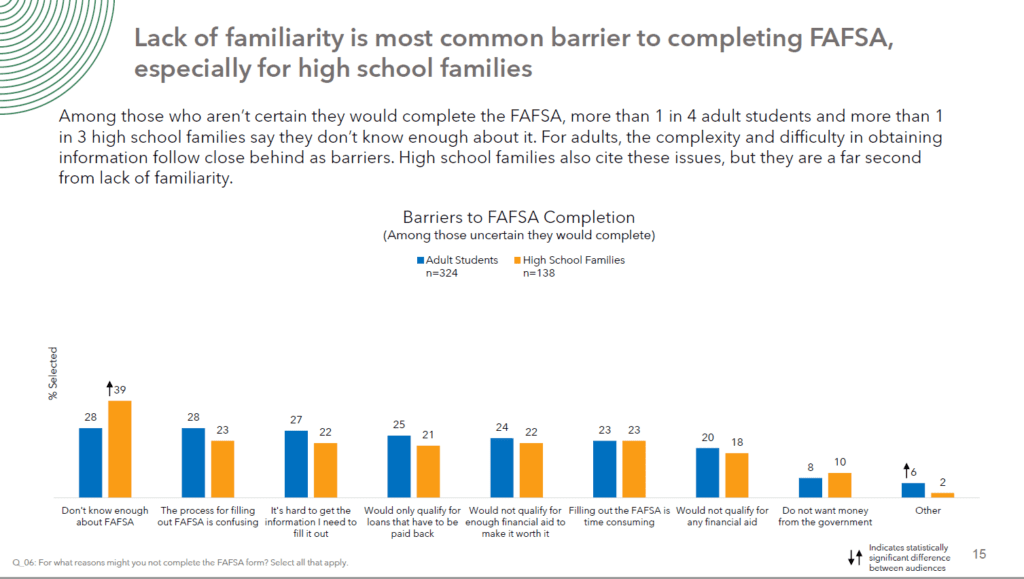

In addition, the research shows that while many people are aware of financial aid opportunities and even the FAFSA, their understanding of what’s involved in filling out the FAFSA and getting aid is low.

Perceptions that FAFSA is cumbersome, concerns about privacy, and the mistaken assumption that their children either won’t qualify or don’t need financial aid, are also deterrents to FAFSA completion, according to the research.

“I heard it was a really long process,” one student said. “Because I remember when my sister was talking about it, she was like, ‘I don’t feel like doing all of this paperwork right now.’”

However, when made aware of how FAFSA opens up opportunities, lowers tuition, and serves as a comprehensive resource for financial aid information, families were more motivated.

Counselors who participated in the research touched on this when they emphasized the importance of highlighting the short-term benefits of filling out a FAFSA: that it is applicable to many kinds of post-secondary education, not just four-year colleges; and that it helps students make an informed decision.

Providing families with more detailed information was identified as one of the strategies most helpful to encouraging FAFSA completion. While a short description piqued some interest, more detailed explanations of financial aid eligibility and the FAFSA process made research participants curious. This was particularly true among Black and Latino students.

“Being able to know all the different opportunities that you can gain from FAFSA pushed forward my want to fill it out,” one student said. “There was still a part of me that was maybe still kind of hesitant about it. Now I’m knowing for sure that that’s what I want to do with this.”

How to message the FAFSA

When it comes to messaging on FAFSA, researchers found that most parents and students prefer messaging that emphasizes the chance of qualifying for financial aid that doesn’t have to be paid back. This was particularly helpful to parents, while students were more swayed by messaging focused on the ease of filling out the FAFSA. Messaging that stressed the need to fill out the FAFSA as early as possible was also particularly impactful. The findings highlighted four messaging non-negotiables:

Informational

The researchers tested various kinds of messaging to determine better ways of saying commonly used phrases. For instance, when told that the FAFSA needs to be filled out “to get financial aid,” some parents brought up concerns about student loan debt. However, when told that FAFSA is “a tool that give you information about what aid you qualify for,” and that there is no requirement to accept aid that is offered, parents were more comfortable.

“You’re simply filling out information … and trying to see what is available for you,” one parent said. “You don’t have to be in debt to do financial aid or to go to school, because, again, it’s not mandatory.”

Transparent

It is important to be transparent and not to overpromise. Don’t offer only positive outcomes but be honest about all the possible options, including different student loans that might have to be paid back.

Specific

Including numbers wherever possible is more encouraging to families. So, for instance, when talking about the Next NC scholarships, campaign materials describes it as a program whereby most families making $80,000 or less will receive a minimum of $3,000 per year for community college and at least $5,000 per year for a UNC institution. This instantly lets many families know that they will likely qualify and how much they can count on.

Objective

Finally, avoid sounding too promotional, the research found. Think car salesman, and then do the opposite.

The research yielded some interesting findings about who students and parents trust when it comes to information about the FAFSA. Both groups rate school counselors, teachers, and academic advisors high. But they also value the opinion of friends and family members who have previous experience.

“A family member or friend that has gone through the process, I’m going to trust them because they’ve been through it,” one parent said.

Make sure you’re prepared

Getting ready to fill out a FAFSA and apply to college can be a confusing and anxiety-inducing experience. It is important that education professionals understand how parents and students perceive college and the college-going process in order to best help them understand the benefits and opportunities available.

With these research findings, educators and counselors can be armed with the tools to help them be successful in ensuring every student has the chance to take advantage of the many resources at their disposal.

To make financial aid information understandable to all students and families, it’s helpful for education professionals to consider the following in how they are sharing information:

- How easy is my organization making it for students to find information about financial aid available?

- How well are we using language that’s easy to understand?

- How well are we sharing information about the different types of aid, particularly aid that doesn’t have to be paid back like scholarships and grants?

- How well are we helping students know about other forms of aid beyond Pell grants to make paying for college more manageable?

- Do we make it easy for students to know where to go if they need more help completing a FAFSA?

![]() Sign up for the EdWeekly, a Friday roundup of the most important education news of the week.

Sign up for the EdWeekly, a Friday roundup of the most important education news of the week.

Recommended reading