Share this story

- You may not know this, but school districts contribute more to teacher retirement than local governments do to their employees' retirement. What's the difference, and why is it happening?

- One district administrator asked why districts pay a higher percentage into the teacher retirement system than local governments do for their employees. We found the answer.

A superintendent asked why districts pay a higher percentage into teacher retirement systems than local governments pay for their employees. Before we answer that, we should explain what exactly we’re talking about.

Retirement systems

There are different retirement systems for North Carolina teachers and local government employees.

There is the Teachers’ and State Employees’ Retirement System (TSERS) and the Local Governmental Employees’ Retirement System (LGERS).

According to information from the state treasurer’s office, in the fiscal year starting in July, employers will pay a contribution rate for teachers of 17.30%. That is for retirement, disability and death benefits, and also includes a one-time retiree supplement from the state budget. When the 6.89% health benefit payment for retirees is taken into account, that percentage goes up to 24.19%.

For LGERS, the employer contribution rate is, generally, 12.10% for most local government employees and 13.04% for law enforcement officers.

So the big question: Why the difference between TSERS and LGERS contribution rates?

What’s going on?

The main reason for the difference “is that TSERS has fewer ‘employees per retiree’ than LGERS does. Therefore, when investment returns don’t meet expectations over a period of decades, the cost of making up for that falls harder on the contribution rate for TSERS employees because there are fewer of them,” according to Dan Way, communications manager for the treasurer’s office. He added that “there are other, more technical reasons,” as well.

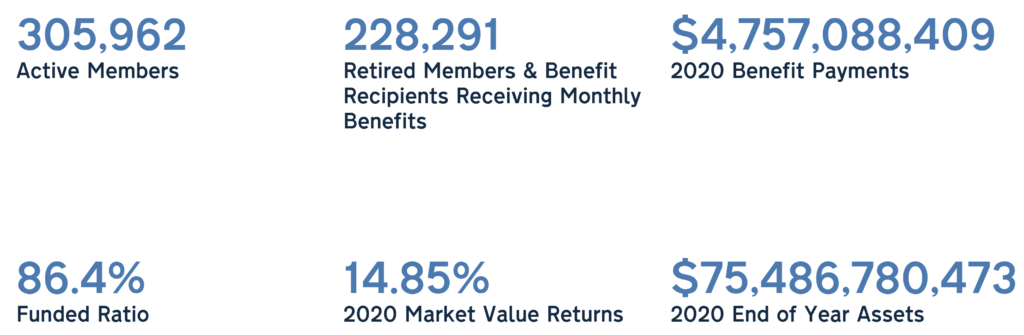

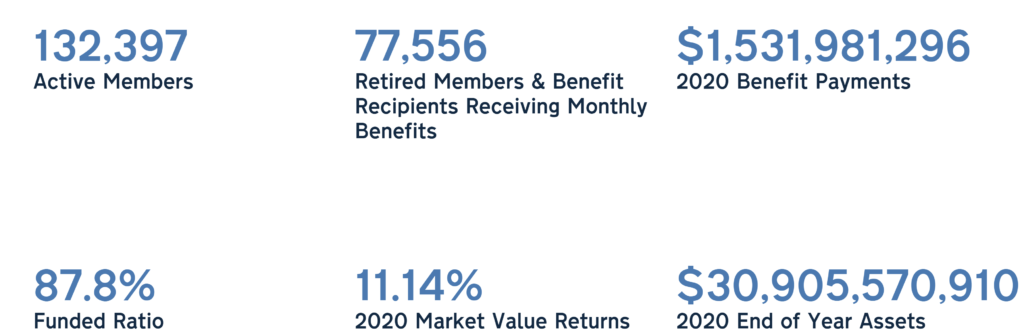

Here is a snapshot of TESRS:

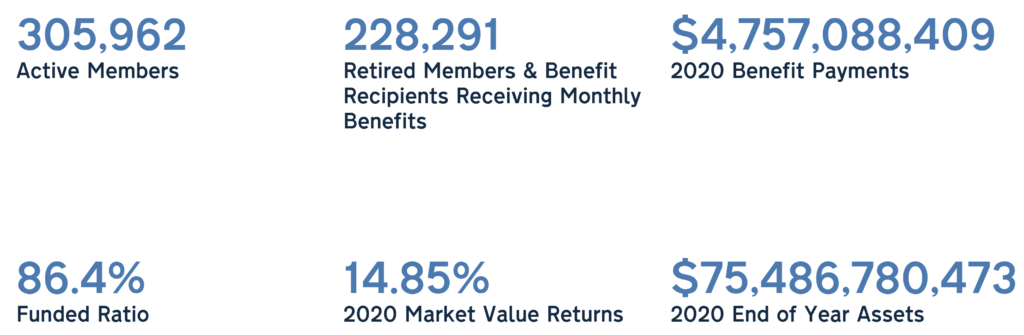

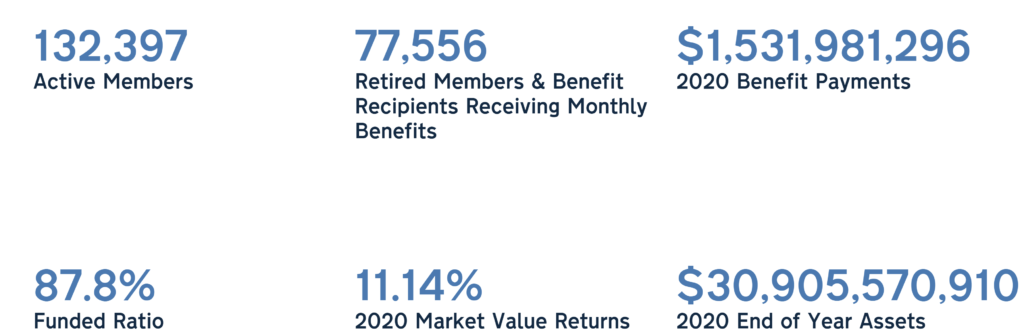

Here is a snapshot of LGERS:

Another explanation (though less significant) has to do with 9/11. After the United States was attacked that year, the state didn’t fully fund TSERS for one year. LGERS, however, was fully funded, according to Way.

The impact of this was greater in the past than it is now.

The difference in funding between the two programs compounded over time, leading to some discrepancies, but both programs developed policies that try to close funding shortfalls within 12 years. So, in the intervening years, the programs have managed to get back up to similar funding percentages, according to Way.

“There should (in theory) have been enough time to catch up for whatever happened 20 years ago,” he said.

Why does all this matter?

This matters because of the burden that falls on local districts when it comes to hiring teachers.

If a district is hiring a teacher using state funds, they also get the money to pay the employer contribution to the teacher’s retirement.

However, if a district is hiring a teacher using local funds, then they are on the hook for the retirement contribution. This might put poorer districts at a disadvantage.

Local money generally comes from funds allocated by the county commissioners. The funds available to the county commissioners often come from property tax revenue. Poorer districts, which tend to be rural, usually get less property tax revenue because there are fewer people who pay the tax. The added expense of paying the retirement contribution on top of covering a teacher’s salary may mean a poorer district can’t afford to hire the teachers it needs.

The relevant statute comes from Section 39.22.(a) of S.L. 2021-180, and you can read it below.

“Effective for the 2021-2023 fiscal biennium, required employer salary-related contributions for employees whose salaries are paid from department, office, institution, or agency receipts shall be paid from the same source as the source of the employee’s salary. If an employee’s salary is paid in part from the General Fund or Highway Fund and in part from department, office, institution, or agency receipts, required employer salary-related contributions may be paid from the General Fund or Highway Fund only to the extent of the proportionate part paid from the General Fund or Highway Fund in support of the salary of the employee, and the remainder of the employer’s requirements shall be paid from the source that supplies the remainder of the employee’s salary. The requirements of this section as to source of payment are also applicable to payments on behalf of the employee for hospital medical benefits, longevity pay, unemployment compensation, accumulated leave, workers’ compensation, severance pay, separation allowances, and applicable disability income benefits.”