The 2026-27 Free Application for Federal Student Aid (FAFSA) form opened on Sept. 24, one week ahead of the anticipated Oct. 1 launch. The application will be open until June 30, 2027, but colleges and states often award aid on a first-come, first-served basis.

The deadline to submit your FAFSA form is June 1, 2026 for UNC System institutions, Aug. 15, 2026 for North Carolina community colleges, and as soon as possible for private institutions, according to studentaid.gov.

Completing the form makes current and prospective college students eligible for need-based financial aid including federal Pell Grants, work-study programs, and student loans. Anticipated in July 2026, Pell Grants can also be used to cover tuition, fees, and other expenses for short-term workforce training programs.

Many states, including North Carolina, also use the FAFSA to award state grants, and colleges use the FAFSA to award their own scholarships. In North Carolina, submitting the FAFSA is a prerequisite for receiving the Next NC Scholarship, which covers full tuition and fees for all North Carolina community colleges and more than half the cost for public universities for most families making $80,000 a year or less.

Students should complete the FAFSA form every year they plan to receive aid.

![]() Sign up for Awake58, our newsletter on all things community college.

Sign up for Awake58, our newsletter on all things community college.

Resources for the FAFSA application

- The 2026-27 FAFSA

- FAFSA FAQ page

- FAFSA Issue Alerts page

- FAFSA deadlines

- FAFSA eligibility requirements

- FAFSA assistance through College for North Carolina (CFNC)

- If you are a student reapplying for the FAFSA, your college’s counseling office is also a great resource.

- Financial Aid Toolkit: Updated resources for school counselors, college access professionals, and mentors with information about the FAFSA process.

- FAFSA videos: Updated videos to help students and families understand the importance of the FAFSA, who is a FAFSA contributor, and what happens after submitting the form

See more on changes to this year’s FAFSA in this article.

How to apply

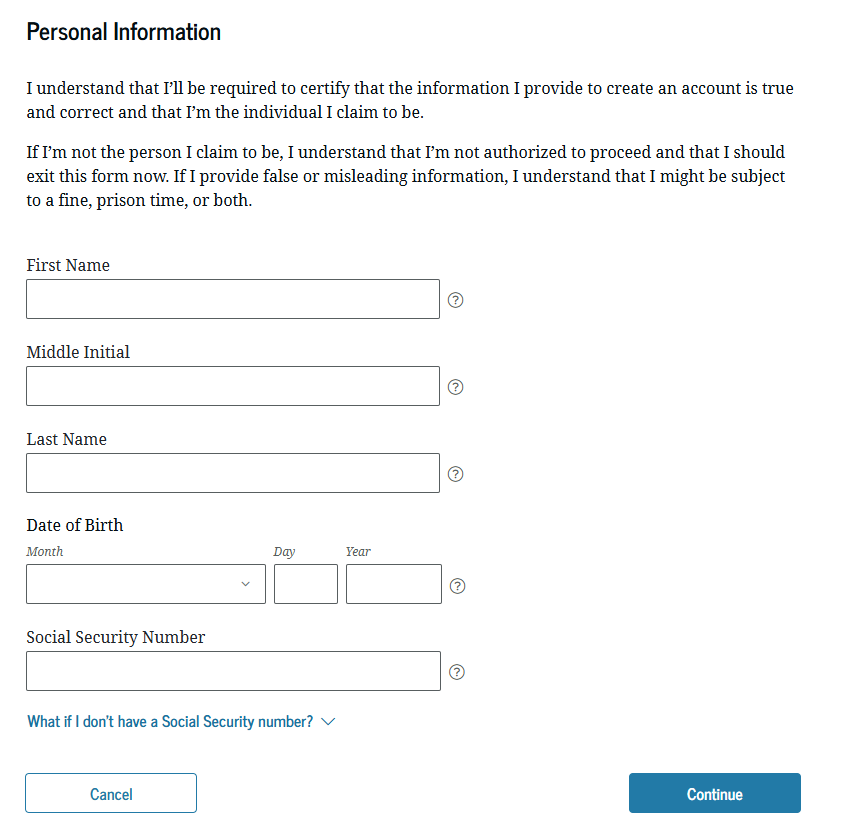

The first step in applying is creating a studentaid.gov account, if you don’t already have one. Then, you can start filling out a new form or resume one that’s in progress.

Your contributors, which may be your parents or a spouse, will also need their own studentaid.gov accounts.

You will be required to enter your Social Security number (SSN) to create an account unless you’re a citizen of the Freely Associated States (the Federated States of Micronesia, the Republic of the Marshall Islands, and the Republic of Palau).

If your contributors do not have an SSN, they can still create an account to complete their section of your FAFSA form. However, if your contributors do have an SSN, you are required to provide the number when inviting them to contribute to your FAFSA form.

Next, gather the documents needed to apply. The FAFSA asks for information about you (your name, date of birth, address, etc.) and your financial situation. Here are some examples of the information you might need:

- Your parents’ SSNs if they have SSNs and you’re a dependent student

- Tax returns

- Records of child support received

- Current balances of cash, savings, and checking accounts

- Net worth of investments, businesses, and farms

The financial data determines a family’s expected out-of-pocket college payments. If those returns don’t reflect your current financial situation, you can file an appeal for a professional judgment review with the school you plan to attend.

Eligibility, citizenship, and parents’ information

According to studentaid.gov, some non-U.S. citizens are eligible to submit the FAFSA form. U.S. nationals and permanent residents are eligible, as are people with an I-94 form showing they are a refugee, asylum grantee, conditional permanent resident, or other applicable designations.

See the full definition of eligible noncitizens here.

Students without legal status, including Deferred Action for Childhood Arrivals (DACA) recipients, are not eligible for federal aid, but may still want to submit the FAFSA as they could be eligible for school-specific aid, private scholarships, or other support.

Parents’ and/or spouses’ immigration status does not affect a student’s FAFSA eligibility.

Read more about FAFSA

Why does the FAFSA matter?

The FAFSA is the gateway to most need-based financial aid for students attending college in the United States.

According to the National College Attainment Network, FAFSA completion is strongly associated with postsecondary enrollment: 92% of high school seniors who completed the FAFSA enrolled by the November following graduation versus 51% who did not complete the FAFSA.

From an attainment perspective, more students being financially supported through college means more students graduating and receiving the financial and other benefits of postsecondary education.

And on an individual level, the less a student has to pay for college, the better.

FAFSA completion rates

“Every eligible student should consider filling out the FAFSA,” says the College Board website.

Despite the benefits of the financial aid FAFSA can unlock, many students don’t submit a form. In 2024-25, fewer than two-thirds of North Carolina high school seniors submitted the FAFSA, according to the CFNC FAFSA tracker. Some North Carolina counties have completion rates under 50%.

(Note: Due to delays in opening a new FAFSA form during the 2024-25 cycle, there were three fewer months for students to submit the form. The tracker says the 2023-24 statewide completion rate was 55.3%, and the 2024-25 statewide completion rate stands at 60.9%.)

myFutureNC has set a goal of an 80% statewide FAFSA completion rate by 2030. North Carolina currently ranks 20th in the nation for FAFSA completion, according to this tracker.

A number of organizations, as well as school districts and colleges, are promoting FAFSA completion. See this 2024 list on myFutureNC’s website. Read more in this EdNC article from May 2024.

Recommended reading